Abstract

When making decisions on the basis of past experiences, people must rely on their memories. Human memory has many well-known biases, including the tendency to better remember highly salient events. We propose an extreme-outcome rule, whereby this memory bias leads people to overweight the largest gains and largest losses, leading to more risk seeking for relative gains than for relative losses. To test this rule, in two experiments, people repeatedly chose between fixed and risky options, where the risky option led equiprobably to more or less than did the fixed option. As was predicted, people were more risk seeking for relative gains than for relative losses. In subsequent memory tests, people tended to recall the extreme outcome first and also judged the extreme outcome as having occurred more frequently. Across individuals, risk preferences in the risky-choice task correlated with these memory biases. This extreme-outcome rule presents a novel mechanism through which memory influences decision making.

Similar content being viewed by others

In decisions from experience, people must rely on their memories of past outcomes to evaluate the available options (Hertwig & Erev, 2009; Hertwig, Barron, Weber, & Erev, 2004; Ludvig & Spetch, 2011; Weber, Shafir, & Blais, 2004). As a result, systematic biases in memory may affect experience-based decisions (Weber & Johnson, 2006). One well-known memory bias is the tendency to recall more salient experiences (Phelps & Sharot, 2008; Talarico & Rubin, 2003). This bias toward peak moments has a strong influence on affective judgments of past events (e.g., Fredrickson, 2000; Yu, Lagnado, & Chater, 2008). We propose that a memory bias for extreme outcomes also occurs in risky decisions from experience, making people more sensitive to the biggest gains and losses they encounter. Consequently, people should become more risk seeking for relative gains than for relative losses—contrary to the risk preferences in decisions from description (Kahneman & Tversky, 1979), but congruent with recent results with decisions from experience (e.g., Ludvig, Madan, & Spetch, 2013; Tsetsos, Chater, & Usher, 2012).

People tend to vividly remember highly emotional events, such as the Kennedy assassination, September 11th, or, more positively, the birth of a child (Brown & Kulik, 1977; Phelps & Sharot, 2008; Talarico & Rubin, 2003). Salient events are also recalled more readily and used to forecast future affective reactions (Morewedge, Gilbert, & Wilson, 2005). Similarly, people show better memory for the most and least rewarding events (e.g., Madan, Fujiwara, Gerson, & Caplan, 2012; Madan & Spetch, 2012). This tendency to remember the best and worst of times also influences affective judgments of painful or pleasant episodes (e.g., Kahneman, Fredrickson, Schreiber, & Redelmeier, 1993). These judgments depend primarily on the points of maximal and final intensity—an effect aptly summarized as the peak–end rule (Fredrickson, 2000). Such a bias also appears in judgments about past risky outcomes: In a simulated gambling task, people gave higher estimates of total payouts after sessions in which the payouts included high peak and end values, as compared with sessions with higher overall payouts but no extreme values (Yu et al., 2008).

We hypothesized that a memory bias for extreme values (both the highest and lowest) may cause these extremes to be overweighted in risky decisions from experience (see Ludvig et al., 2013). Following this extreme-outcome rule, when a risky option occasionally leads to the best possible gain in a context, that large gain will tend to be better remembered than other outcomes and overweighted in subsequent decisions; consequently, the risky option will be chosen more often. By the same logic, risky options that occasionally lead to the worst outcome in a context will be chosen less often. With repeated experience, people should thus become more risk seeking for relative gains than for relative losses.

The pattern of risk preference predicted by the extreme-outcome rule is opposite to the reflection effect observed in decisions from description (e.g., Kahneman & Tversky, 1979) but accords with the greater risk seeking for relative gains than for relative losses observed in recent experiments on repeated decisions from experience (e.g., Ludvig & Spetch, 2011; Ludvig et al., 2013; Tsetsos et al., 2012). For example, Tsetsos et al. had people choose between two reward distributions, which were learned about through a rapid visual stream of possible outcomes. When the task was to select a distribution, thereby highlighting the highest values, people were risk seeking, but when the task was to reject a distribution, thereby highlighting the lowest values, people were risk averse. Similarly, we found that people were more risk seeking for relative gains than for relative losses in decisions from experience (Ludvig et al., 2013). Increased risk seeking for gains is also regularly observed in rhesus monkeys when they make rapid, repeated, small-stakes decisions (Heilbronner & Hayden, 2013).

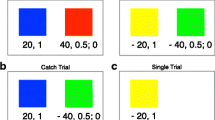

The present experiments directly tested whether a memory bias for extreme outcomes drives these risky decisions. In both experiments, participants completed a choice task and a memory task. Figure 1 illustrates the choice task. People repeatedly chose between pairs of doors. One door always led to the same fixed outcome, whereas the other (risky) door led to more or less than the fixed outcome with a 50/50 chance. Importantly, gain and loss problems (Experiment 1) or high- and low-value problems (Experiment 2) were randomly intermingled in the task. This provided a context in which each risky option led to either an extreme or a nonextreme outcome with a 50/50 chance. The choice task was followed by two memory tests, which were the focus of the present article. First, participants reported the first outcome that came to mind for each door. Second, participants judged the frequency that each door was followed by a particular outcome. Both memory tests revealed systematic biases that correlated with risky choice.

Choice task. a Decision trials involved choices between two gain or two loss doors. One door always led to a gain (or loss) of a fixed number of points, and the other door led equiprobably to one of two possible outcomes. Choices were followed by feedback about the amount gained (or lost). b Catch trials involved choices between one gain door and one loss door. c Single-door trials presented only one door that had to be chosen

Experiment 1

Method

Participants

One hundred fourteen introductory psychology students at the University of Alberta participated for course credit and a performance-based monetary bonus (80 females; M age = 19.6 years). The research was approved by a university ethics board.

Procedure

Choice task

Figure 1 illustrates the task. On each trial, participants saw pictures of one or two doors on a computer screen and selected one by clicking on it. Choices were immediately followed by feedback in which the points won/lost, along with a cartoon graphic, were displayed for 1.2 s. Feedback was given only for the chosen door, as in a partial-feedback procedure (Hertwig & Erev, 2009). Total accumulated points were continuously displayed on the screen. An interval of 1–2 s separated trials.

Sessions consisted of five blocks of 48 trials. Each block included a mixture of trial types: There were 24 decision trials that required a choice between either two gain doors or two loss doors (12 of each; Fig. 1a). In both cases, the fixed door always led to the same outcome (+20 or −20), and the risky door led equiprobably to double the fixed outcome (+40 or −40) or nothing (0). There were 16 catch trials that required a choice between a gain door and a loss door (see Fig. 1b). These trials ensured that participants were engaged in the task. Data from 7 participants who chose the gain door on fewer than 60 % of these catch trials were excluded. On 8 single-door trials, there was only one door, which had to be selected to continue (2 of each; Fig. 1c). These trials guaranteed that all reward contingencies were experienced, even if the doors were initially unlucky, thereby limiting any hot-stove effects (Denrell & March, 2001).

Participants won or lost points on all 240 trials and were paid $1 for every 400 points to a maximum of $5. Trial order was randomized within blocks. Each door appeared equally often on either side of the screen and in combination with the other doors. Door color was counterbalanced across participants.

Memory tests

After the choice task, participants’ memory for the outcomes associated with each door was tested in two ways. First, participants were shown the four doors in random order and were asked to report for each the first outcome that came to mind. Second, participants were again shown the four doors in random order and were asked to judge the frequency, as a percentage, of each of the possible outcomes (−40, −20, 0, +20, and +40). For each door, these outcomes were displayed simultaneously, and participants typed a number from 0 to 100 beside each outcome.

Data analysis

Risk preference was operationalized as the probability of choosing the risky door over the final three blocks—after sufficient opportunity to learn the outcomes associated with each door. To assess the relationships between risky choice and memory, we used partial correlations (see Abdi, 2007) that controlled for the actual outcomes experienced. This approach allowed us to measure the relationship between risky choice and memory that occurred over and above any effect of the actual outcomes that participants experienced. Thus, the correlations we report cannot be attributed to differences in reward history. Given the a priori hypotheses, all tests were one-tailed, except where indicated.

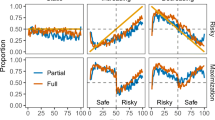

Results

As was predicted, Fig. 2a shows how, on the choice task, participants were significantly more risk seeking for gains than for losses in the final three blocks, t(106) = 1.86, p < .05, d = 0.23. Across blocks (Fig. 2b), the proportion of risky choices decreased for losses [linear effect of block: F(1, 106) = 39.49, p < .001, η p 2 = .27] but stayed constant for gains [linear effect of Block: F(1, 106) < .001, p > .1, η p 2 < .001]. These risk preferences were modulated by recent outcomes. Figure 2c shows the proportion of risky choices for gains and losses, split by whether the most recently experienced risky option of that valence yielded the good (+40 for gain or 0 for loss) or bad (0 for gain or −40 for loss) outcome. There was more risk seeking following the good outcome for both gains, t(106) = 2.68, p < .01, d = 0.10, and losses, t(106) = 4.21, p < .001, d = 0.36, resembling a win-stay/lose-shift pattern.

Choice results for Experiment 1. a Mean risk preference (±SEM) for gain and loss doors averaged over the last three blocks. b Mean risk preference (±SEM) for gain and loss doors for each block. c Mean risk preference (±SEM) for gain and loss doors averaged over the last three blocks, separated by the most recent risky outcome experienced on that door

When asked, after the task, the first outcome to come to mind, people were significantly more likely to report the extreme outcome (+40 or −40) than the zero outcome for both gains, χ 2(1, N = 90) = 10.00, p < .01, and losses, χ 2(1, N = 88) = 38.23, p < .001. Figure 3b plots risk preference in the choice task on the basis of participants’ responses to this first-outcome question. For gains, people who reported +40 were more risk seeking than those who reported 0, r p(87) = .31, p < .01, and for losses, people who reported −40 were less risk seeking than those who reported 0, r p(86) = −.44, p < .001, even after controlling for any effect of outcomes received.

Memory results for Experiment 1. a Proportions of participants who responded with ±40, 0, or neither in the first-outcome question. b Mean risk preference (±SEM) for gains and losses, split on the basis of what the participant reported to the first-outcome question. c Mean judged percent (±SEM) for the ±40 and 0 outcomes from the frequency judgment question. For simplicity, all other values were coded as “Other.” d Scatterplot of risk preference and frequency judgment responses for the gain and loss doors. Each dot represents an individual participant

Frequency judgments showed a similar pattern (Fig. 3c): People reported significantly higher percentages for the extreme outcome (+40 or −40) than for the zero outcome for both gains, t(106) = 2.70, p < .01, d = 0.38, and losses, t(106) = 6.78, p < .001, d = 1.05. Figure 3d plots risk preference in the choice task against frequency judgments for the extreme outcomes (+40 or −40). For gains, risk seeking increased with the judged frequencies of the +40 outcome, r p(105) = .16, p < .05, whereas for losses, risk seeking decreased with the judged frequency of the −40 outcome, r p(105) = −.48, p < .001, even after controlling for the outcomes received. We also tested for potential primacy and recency effects in the memory tests. For both gains and losses, neither the first outcome experienced nor the last outcome experienced correlated with the results on either memory test (all ps > .1, two-tailed).

Nearly half the participants reported the correct proportions of the outcomes (50/50). Nonetheless, these participants showed the same memory biases in the first-outcome question. Of those who correctly reported gains, 23 % of subjects reported 0 and 53 % reported +40 as the first outcome, χ 2(1, N = 45) = 9.80, p < .01. Of those who correctly reported losses, 73 % of subjects reported −40 and 9 % reported 0 as the first outcome, χ 2(1, N = 36) = 21.78, p < .001 (cf. Fig. 3a). These participants also showed the same pattern of greater risk seeking for gains (45 %) than for losses (38 %) (cf. Fig. 2a). Thus, even participants who accurately reported the contingencies showed biases in memory accessibility and risky choice.

Discussion

In Experiment 1, the extreme outcomes were overweighted in memory, and the relative weighting correlated with risky choice across individuals (see Fig. 3). These outcomes were the biggest gains and losses experienced, leaving open the question as to whether the absolute or relative extremes are important. Tsetsos et al. (2012), for example, found that both the high and low extremes could be overweighted, even with all gains (see also Ludvig et al., 2013). To test this possibility, Experiment 2 restricted all outcomes to the gain domain by shifting outcomes up by 40 points from Experiment 1. The high extreme was thus +80, and the low extreme was 0. If the relative extremes are critical, we should see similar overweighting of these extremes in the memory tests and risky choice.

Experiment 2

Method

Participants

Seventy-two participants were drawn from the same pool as in Experiment 1 (47 females; M age = 19.4 years).

Procedure

The procedure was almost identical to that in Experiment 1, except that all outcomes were gains. On high-value decisions, the fixed door led to +60, and the risky door led equiprobably to +40 or +80. On low-value decisions, the fixed door led to +20, and the risky door led equiprobably to 0 or +40 (identical to the gain problem of Experiment 1). Thus, the extreme outcomes were +80 (best outcome) and 0 (worst possible). The number and distribution of decision, single-door, and catch trials in each run were the same as in Experiment 1. Catch trials were between a high-value door and a low-value door, with 4 participants excluded because they chose correctly <60 % of the time. The session contained six blocks of 48 trials. Participants were paid $1 for every 3,600 points to a maximum of $5. The memory tests were identical to those in Experiment 1, except that the frequency test displayed outcomes of 0, +20, +40, +60, and +80.

Results

As was predicted, Fig. 4a shows how participants were more risk seeking in high-value decisions than in low-value decisions over the final blocks, t(67) = 9.41, p < .001, d = 1.44. Over blocks, high-value decisions showed no significant change [linear effect of block: F(1, 67) = 0.60, p > .1, η p 2 = .009], whereas risk preference decreased for low-value decisions [linear effect of block: F(1, 67) = 31.08, p < .001, η p 2 = .32] (Fig. 4b). Figure 4c displays how risk seeking was greater following a recent good outcome on the risky option for both the high-value decisions, t(67) = 2.78, p < .01, d = 0.13, and the low-value decisions, t(67) = 4.61, p < .001, d = 0.50. Independent of recent outcomes, however, risk seeking was greater in the high-value than in the low-value decisions.

Results for Experiment 2. a Mean risk preference (±SEM) for gain and loss doors averaged over the last three blocks. b Mean risk preference (±SEM) for gain and loss doors for each block. c Mean risk preference (±SEM) for gain and loss doors averaged over the last three blocks, separated by the most recent risky outcome experienced on that door. d Mean risk preference (±SEM) for gains and losses, split on the basis of what the participant reported to the first-outcome question. e Scatterplot of risk preference and frequency judgment responses for the gain and loss doors. Each dot represents an individual participant

On the first-outcome memory tests, more people reported the extreme outcomes (80 or 0) than the nonextreme outcomes (40) for both the high-value, χ 2(1, N = 61) = 2.77, p < .05, and the low-value, χ 2(1, N = 62) = 47.03, p < .001, risky doors. Figure 4d shows that for high-value decisions, people who reported 80 were more risk seeking in the choice task than those who reported 40, r p(58) = .58, p < .001. For low-value decisions, people who reported 0 were less risk seeking than those who reported 40, r p(59) = −.46, p < .001.

For the frequency judgments, the extreme outcome was judged as more frequent than the nonextreme outcomes for the low-value decisions, t(65) = 11.46, p < .001, d = 1.41, but not for the high-value decisions, t(65) = 0.09, p > .1, d = 0.01. In both cases, however, Fig. 4e shows how the judged frequencies correlated with risky choices, even after controlling for the experienced outcomes. Higher judged frequencies for the negative extreme (0) correlated with less risk seeking in the low-value decisions, r p(63) = −.24, p < .05, and higher judged frequencies for the positive extreme (+80) correlated with more risk seeking in the high-value decisions, r p(63) = .23, p < .05.

General discussion

These two experiments provide evidence that a memory bias for extreme outcomes influences risk preference in decisions from experience. As is predicted by the extreme-outcome rule, people were more risk seeking for relative gains than for relative losses—contrary to the usual results in decisions from description (Kahneman & Tversky, 1979), but in agreement with recent results in decisions from experience (Ludvig et al., 2013; Ludvig & Spetch, 2011; Tsetsos et al., 2012). Furthermore, people tended to recall the extreme outcomes more readily than the nonextreme outcomes and tended to overestimate their relative frequency. Across individuals, both memory biases correlated with risky choice: Overweighting of the high extreme led to more risk seeking, whereas overweighting of the low extreme led to more risk aversion. These results support an extreme-outcome rule, whereby the biggest gains and losses are better remembered and shift risk preferences in decisions from experience.

Our results provide a new addition to the literature on decisions from experience, which has highlighted how rare events are underweighted in experience (Hertwig et al., 2004; Hertwig & Erev, 2009; Weber et al., 2004). In the present study, however, there were no rare events, and both risky options led to equiprobable outcomes. Our extreme-outcome rule does make a clear prediction for cases with rare events: When the rare event is also the extreme outcome in that context, any underweighting should be diminished. Moreover, unlike many studies on decisions from experience, our choice task intermingled a gain and a loss problem or a high-value and a low-value problem. This intermingling established a decision context in which the largest gain and the largest loss followed different risky options, thereby allowing an overweighting of extremes to bias risky choice (see also Ludvig et al., 2013).

The high and low extremes do not, however, carry equal weight. The overweighting of the low extreme in memory was more pronounced. Similarly, when faced with a risky option that led to the low extreme, people were significantly risk averse but were only risk neutral (or moderately risk seeking) when faced with a risky option that led to the high extreme. The risk neutrality is not immediately concordant with our extreme-outcome rule. If the extreme outcome were truly overweighted, absolute risk seeking should be observed. One possible resolution is that worse outcomes are more heavily weighted than better outcomes, akin to loss aversion, whereby losses loom larger than gains (Kahneman & Tversky, 1979; Yechiam & Hochman, 2013). As a result, when the worse outcome is also the extreme (as with the relative losses), there is significant risk aversion, but when the better outcome is the extreme (as with the relative gains), the risk aversion is reduced (Experiment 1) or reversed (Experiment 2). In other situations when both (or neither) outcomes are extreme, this negatively biased weighting would produce risk aversion, as has been observed in other experiments on risky decisions from experience with equiprobable outcomes (Erev et al., 2010; Ert & Yechiam, 2010; Niv, Edlund, Dayan, & O’Doherty, 2012).

One possible reason that intermingling multiple problems results in a bias toward the extreme outcomes in both risky choice and memory is that the pairing implicitly introduces a choose/reject problem frame (Shafir, 1993; Tsetsos et al., 2012). Following this idea, in the gain and high-value cases, people focus on which option to choose, whereas in the loss and low-value cases, people focus on which option to reject. In verbally described problems, people were influenced by the most positive attributes when selecting an option but were focused on the most negative attributes when rejecting one (Shafir, 1993). In our experiments, people were similarly influenced by the positive extremes in the highest-value decisions, but by the negative extremes in the lowest-value decisions (see also Tsetsos et al., 2012).

The observed bias toward remembering extreme values is consistent with other memory studies (Madan & Spetch, 2012; Phelps & Sharot, 2008; Talarico & Rubin, 2003) and is a partial extension of the peak–end rule to risky choice (e.g., Fredrickson, 2000; Yu et al., 2008). This memory bias could readily be incorporated into recent theories that posit memory retrieval as a key component of decision making, such as the decision-by-sampling framework (Stewart, Chater, & Brown, 2006), query theory (Johnson, Häubl, & Keinan, 2007), or instance-based learning (Gonzalez & Dutt, 2011). In demonstrating that extreme outcomes bias both memory and risky choice in the same task, our study provides a novel link between the memory and decision-making literatures.

The two memory tests yielded similar, but not identical, results. In all instances, the first-outcome memory test showed a bias toward the extreme outcome and a significant correlation with the proportion of risky choices. The frequency judgments generally showed a bias toward the extreme outcome, except for the high-value decision in Experiment 2, and the correlations with risky choice, although statistically reliable, were less robust than the first-outcome results. Moreover, the same bias in the first-outcome tests (and risky choice pattern) appeared even for participants who reported the exact 50/50 outcomes in the frequency judgments test. Taken together, these results suggest that the memory effect seems to be more one of relative accessibility than one of explicit misjudgment (although this happens too). There is also the possibility that the biases observed in the memory tests and choice patterns were both produced by a common cause, such as the increased saliency of the extreme outcomes when they occurred (e.g., Niv et al., 2012; Tsetsos et al., 2012). We did not explicitly manipulate or measure the saliency of the different outcomes, leaving this question open for future research. Finally, independent of these memory biases, there was still significant interindividual variability in risk preference (Figs. 3d/4e), which likely reflects factors outside of experimental control, such as personality traits or socioeconomic status (e.g., Ginley, Whelan, Meyers, Relyea, & Pearlson, 2013; Griskevicius, Tybur, Delton, & Robertson, 2011).

People are continuously confronted with risky decisions—be it shopping at the mall, picking medical treatments, or gambling at a casino. Our research suggests that when people base choices on past experience, their propensity for risk can be influenced by memory biases—in particular, a tendency to remember extreme outcomes. These results highlight the degree to which memory processes can inform and influence our decision making.

References

Abdi, H. (2007). Part and partial correlations. In N. J. Salkind (Ed.), Encyclopedia of measurement and statistics (pp. 736–740). Thousand Oaks, CA: Sage.

Brown, R., & Kulik, J. (1977). Flashbulb memories. Cognition, 5, 73–99.

Denrell, J., & March, J. G. (2001). Adaptation as information restriction: The hot stove effect. Organization Science, 12, 523–538.

Ert, E., & Yechiam, E. (2010). Consistent constructs in individuals’ risk taking in decisions from experience. Acta Psychologica, 134, 225–232

Erev, I., Ert, E., Roth, A. E., Haruvy, E., Herzog, S. M., Hau, R., Hertwig, R., Stewart, T., West, R., & Lebiere, C. (2010). A choice prediction competition: Choices from experience and from description. Journal of Behavioral Decision Making, 23, 15–47.

Fredrickson, B. L. (2000). Extracting meaning from past affective experiences: The importance of peaks, ends, and specific emotions. Cognition & Emotion, 14, 577–606.

Ginley, M.K., Whelan, J.P., Meyers, A.W., Relyea, G.E., & Pearlson, G.D. (2013). Exploring a multidimensional approach to impulsivity in predicting college student gambling. Journal of Gambling Studies. in press

Gonzalez, C., & Dutt, V. (2011). Instance-based learning: Integrating sampling and repeated decisions from experience. Psychological Review, 118, 523–551.

Griskevicius, V., Tybur, J. M., Delton, A. W., & Robertson, T. E. (2011). The influence of mortality and socioeconomic status on risk and delayed rewards: A life history theory approach. Journal of Personality and Social Psychology, 100, 1015–1026.

Heilbronner, S. R., & Hayden, B. Y. (2013). Contextual factors explain risk-seeking preferences in rhesus monkeys. Frontiers in Neuroscience, 7, 7.

Hertwig, R., & Erev, I. (2009). The description-experience gap in risky choice. Trends in Cognitive Sciences, 13, 517–523.

Hertwig, R., Barron, G., Weber, E. U., & Erev, I. (2004). Decisions from experience and the effect of rare events in risky choice. Psychological Science, 15, 534–539.

Johnson, E. J., Häubl, G., & Keinan, A. (2007). Aspects of endowment: A query theory of value construction. Journal of Experimental Psychology: Learning Memory & Cognition, 33, 461–474.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47, 263–292.

Kahneman, D., Fredrickson, B. L., Schreiber, C. A., & Redelmeier, D. A. (1993). When more pain is preferred to less: Adding a better end. Psychological Science, 4, 401–405.

Ludvig, E. A., & Spetch, M. L. (2011). Of black swans and tossed coins: Is the description-experience gap in risky choice limited to rare events? PLoS ONE, 6, e20262.

Ludvig, E.A., Madan, C.R., & Spetch, M.L. (2013). Extreme outcomes sway experience-based risky decisions. Journal of Behavioral Decision Making. in press

Madan, C. R., & Spetch, M. L. (2012). Is the enhancement of memory due to reward driven by value or salience? Acta Psychologica, 139, 343–349.

Madan, C. R., Fujiwara, E., Gerson, B. C., & Caplan, J. B. (2012). High reward makes items easier to remember, but harder to bind to a new temporal context. Frontiers in Integrative Neuroscience, 6, 61.

Morewedge, C. K., Gilbert, D. T., & Wilson, T. D. (2005). The least likely of times: How remembering the past biases forecasts of the future. Psychological Science, 16, 626–630.

Niv, Y., Edlund, J. A., Dayan, P., & O’Doherty, J. P. (2012). Neural prediction errors reveal a risk-sensitive reinforcement-learning process in the human brain. Journal of Neuroscience, 32, 551–562.

Phelps, E. A., & Sharot, T. (2008). How (and why) emotion enhances the subjective sense of recollection. Current Directions in Psychological Science, 17, 147–152.

Shafir, E. (1993). Choosing versus rejecting: Why some options are both better and worse than others. Memory & Cognition, 21, 546–556.

Stewart, N., Chater, N., & Brown, G. D. A. (2006). Decision by sampling. Cognitive Psychology, 53, 1–26.

Talarico, J. M., & Rubin, D. C. (2003). Confidence, not consistency, characterizes flashbulb memories. Psychological Science, 14, 455–461.

Tsetsos, K., Chater, N., & Usher, M. (2012). Salience driven value integration explains decision biases and preference reversal. Proceedings of the National Academy of Sciences USA, 109, 9659–9664.

Weber, E. U., & Johnson, E. J. (2006). Constructing preferences from memories. In S. Lichtenstein & P. Slovic (Eds.), The construction of preference (pp. 397–410). New York: Cambridge University Press.

Weber, E. U., Shafir, S., & Blais, A.-R. (2004). Predicting risk sensitivity in humans and lower animals: Risk as variance or coefficient of variation. Psychological Review, 111, 430–445.

Yechiam, E., & Hochman, G. (2013). Losses as modulators of attention: Review and analysis of the unique effects of losses over gains. Psychological Bulletin, 139, 497–518.

Yu, E. C., Lagnado, D. A., & Chater, N. (2008). Retrospective evaluations of gambling wins: Evidence for a ‘peak-end’ rule. Conference of the Cognitive Science Society, 30, 77–82.

Acknowledgments

Research was funded by grants from the Alberta Gambling Research Institute (AGRI) and the National Science and Engineering Research Council (NSERC) of Canada held by M.L.S. C.R.M. was supported by scholarships from AGRI and NSERC. E.A.L. was supported by NIH Grant #P30 AG024361. We thank the Explore-Exploit Group at Princeton for insightful discussions and Ashley Rodgers for research help. Door images were extracted from “Irish Doors” on fineartamerica.com, with permission from Joe Bonita.

Author information

Authors and Affiliations

Corresponding author

Additional information

Christopher R Madan and Elliot A Ludvig contributed equally to this work.

Rights and permissions

About this article

Cite this article

Madan, C.R., Ludvig, E.A. & Spetch, M.L. Remembering the best and worst of times: Memories for extreme outcomes bias risky decisions. Psychon Bull Rev 21, 629–636 (2014). https://doi.org/10.3758/s13423-013-0542-9

Published:

Issue Date:

DOI: https://doi.org/10.3758/s13423-013-0542-9