Abstract

Ownership is a powerful construct. Indeed, in a series of recent studies, perceived ownership has been shown to increase attentional capacity, facilitate a memorial advantage, and elicit positive attitudes. Here, we sought to determine whether self-relevance would bias reward evaluation systems within the brain. To accomplish this, we had participants complete a simple gambling task during which they could “win” or “lose” prizes for themselves or for someone else, while electroencephalographic data were recorded. Our results indicated that the amplitude of the feedback error-related negativity, a component of the event-related brain potential sensitive to reward evaluation, was diminished when participants were not gambling for themselves. Furthermore, our data suggest that the ownership cues that indicated who would win or lose a given gamble either were processed as a potential for an increase in utility (i.e., gain: self-gambles) or were processed in a nonutilitarian manner (other-gambles). Importantly, our results suggest that the medial-frontal reward system is sensitive to perceived ownership, to the extent that it may not process changes in utility when they are not directly relevant to self.

Similar content being viewed by others

Introduction

Most of us are familiar with the story of Nick Leeson, the derivatives trader whose unauthorized moves on the Singapore stock market led to the collapse of Barings, the oldest investment bank in the United Kingdom, and an eventual loss of £827 million pounds sterling ($1.4 billion US dollars). Leeson’s behavior is not an isolated example; there are plenty of other recent examples where people have gambled with and lost huge sums of other people’s money. Jerome Kerviel, the speculatives trader with the Societe Generale Bank lost the equivalent of $7.2 billion, and, of course, there are the traders who were involved with the stock market crash in the United States in 2000. While Leeson himself admitted that “I know what I did was wrong,” would he have been as reckless if the money he was gambling with was his? Could one of the contributing factors to Leeson’s behavior be that the neural systems within his brain responsible for reward evaluation did not process the losses because he was gambling with someone else’s money?

The outcomes of the events in our lives have great importance for us, particularly if they result in a gain in utility or, in simpler terms, a reward. Indeed, utilitarianism is posited on this notion, that inherent to our very nature is a desire to maximize positive and rewarding outcomes (Mill, 1879). Supporting the idea of utilitarianism, Holroyd and Coles (2002) have proposed that within the medial-frontal cortex, there is a reward-learning system that has the specific goal of optimizing task performance in order to maximize utility. While the medial-frontal reward system has been shown to process wins and losses in simple gambling tasks (Hajcak, Holroyd, Moser, & Simons, 2005; Hajcak, Moser, Holroyd, & Simons, 2006, Hajcak, Moser, Holroyd, & Simons, 2007; Hewig et al., 2007; Holroyd & Krigolson, 2007; Holroyd, Krigolson, & Lee, 2011; Holroyd, Pakzad-Vaezi, & Krigolson, 2008; Yeung & Sanfey, 2004), it is quite generic in terms of performance evaluation and has also been shown to process task-related feedback in cognitive tasks (Holroyd & Krigolson, 2007; Miltner, Braun, & Coles, 1997), during motor skill acquisition (Krigolson & Holroyd, 2006, 2007a, b; Krigolson, Holroyd, Van Gyn, & Heath, 2008, and during the acquisition of perceptual expertise (Krigolson, Pierce, Holroyd, & Tanaka, 2009).

The reward signals generated by the medial-frontal system are thought to reflect prediction errors—discrepancies between actual and expected outcomes (Holroyd & Coles, 2002; Holroyd & Krigolson, 2007; O'Doherty, 2004; Schultz, Dayan, & Montague, 1997; Sutton & Barto, 1998). Importantly, these prediction errors provide an adaptive advantage in that positive outcomes are reinforced and behaviors leading to negative outcomes are extinguished (Holroyd & Coles, 2002; Schultz, Apicella, Romo, & Scarnati, 1995; Sutton & Barto, 1998). While the medial-frontal reward-learning system is sensitive to changes in utility on outcomes for oneself, what is less certain is whether or not it is equally sensitive to one’s actions if they result in rewards and losses for others— in other words, if there is no ownership of the change in utility.

A series of recent studies have shown that objects owned by oneself appear to be afforded increased attentional capacity, enjoy a memorial advantage, and elicit positive attitudes, even when this sense of ownership is imaginary, transient, and experimentally defined (Beggan, 1992; Belk, 1988, 1991; Cunningham, Turk, Macdonald, & Neil Macrae, 2008; Gray, Ambady, Lowenthal, & Deldin, 2004; Huang, Wang, & Shi, 2009; Turk, van Bussel, Brebner, Toma, Krigolson, & Handy, 2011; Turk, van Bussel, Waiter, & Macrae, 2011; van den Bos, Cunningham, Conway, & Turk, 2010). Functional magnetic resonance imaging has revealed that these ownership effects mediate responses in the medial-frontal and insular cortex, areas known to be associated with reward evaluation (Turk, van Bussel, Waiter, et al., 2011). In another recent study using event-related brain potentials (ERPs), ownership cues were shown to modulate attentional processing (Turk, van Bussel, Brebner, et al., 2011). In sum, a growing body of evidence suggests that multiple neural systems are sensitive to processing objects owned by self.

But while relevance to self has been shown to enhance the activity of multiple neural systems, what about relevance to another, especially with regard to reward processing? A recent series of studies examining the neural basis for observational learning have found that the medial-frontal reward system is sensitive to the mistakes and losses of others. For example, early work by van Schie, Mars, Coles, and Bekkering (2004) found that participants who observed response errors made by another had a neural response similar to that evoked by self-feedback processing (i.e., the feedback-related negativity; Miltner et al., 1997). Extending from this, Bellebaum, Polezzi, and Daum (2010) demonstrated that the observation of feedback provided to another participant elicited a similar neural response in a participant observing a task in which money could be won or lost. As such, these studies, and others examining observational learning (Kozba, Thoma, Daum, & Bellebaum, 2011; Shane, Stevens, Harenski, & Kiehl, 2008), suggest that the medial-frontal reward system may underlie observational learning and, thus, is activated when people observe outcomes experienced by others. Furthermore, more recent work by Koban, Pourtois, Bediou, and Vuilleumier (2012) has further extended the observational learning literature by demonstrating that social context can also enhance or reduce the functional efficacy of the medial-frontal reward system. Specifically, Koban et al. found that reward processing was enhanced when participants were in a cooperative, relative to a competitive, situation—a result suggesting that social context also influences reward evaluation by the medial-frontal system.

In the present study, we tested whether neural responses to reward are mediated by first- and third-person utilitarian outcomes (i.e., whether objects are won or lost for oneself or another person). To accomplish this, we had participants play a simple gambling game in which they won or lost prizes for themselves or another, while ERPs were recorded. On each trial, participants were shown an object that was the prize of the gamble. Subsequent to this, participants were cued as to whether or not they or someone else would win or lose the item as a result of the gamble. Next, the game was played, and participants were informed whether the item had been won or lost. Our primary dependent measure was the amplitude of the feedback error-related negativity (fERN; Miltner et al., 1997), an ERP component differentially sensitive to wins and losses in gambling tasks (Hajcak et al., 2005; Holroyd et al., 2008; Yeung & Sanfey, 2004) and thought to be generated by the reward evaluation system within the medial-frontal cortex (Holroyd & Coles, 2002).

At issue was whether the fERN would be sensitive to the results of gambles across self- and other-ownership conditions. Here, we hypothesized that self-relevant gambling results would elicit an fERN. However, what was less certain was how the medial-frontal system would be impacted when participants gambled for another. One possibility was that other gambles would elicit an fERN if participants viewed these gambles as an opportunity to learn or if participants were biased by social context. Another possibility, however, was that participants would not be sensitive to changes in utility for another—a possibility that led us to hypothesize that the outcomes of other gambles might not elicit an fERN at all.

Finally, we were also intrigued by the possibility that the ownership cues themselves might activate the medial-frontal reward system. Specifically, we hypothesized that self-ownership cues might be associated with a potential gain of utility, whereas other-ownership cues might not be. As such, we predicted that we would observe a neural response similar to the fERN when we contrasted the ERP waveforms for the self- and other-ownership conditions.

Method

Participants

Thirty right-handed college-aged participants (14 male, 16 female; age, 19–31 years) with no known neurological impairments and with normal or corrected-to-normal vision took part in the experiment. All of the participants were volunteers who received credit in undergraduate psychology courses for their participation. The participants provided informed consent in line with Dalhousie University’s Policy on the Ethical Conduct of Research Involving Humans, and the study was conducted in accordance with the ethical standards prescribed in the 1964 Declaration of Helsinki and subsequent amendments to the declaration.

Apparatus and procedure

Participants performed a gambling task in which they either won or lost items (e.g., an iPod) shown to them on a computer monitor. At the outset of the experiment, participants were told that they would be playing a gambling task akin to a T.V. game show where they could “win” prizes for themselves or for another participant. Participants never met the “other participant” and were told that the other participant had already played the game or would play the game at some future point in time. Participants were aware that the game show was a fiction—that is, that they would not win any of the prizes that they would be shown. In spite of this fiction, in line with previous work (i.e., Turk, van Bussel, Brebner, et al., 2011; Turk, van Bussel, Waiter, et al., 2011), we believed that the self- and other-ownership cues would still impact the neural processing of the gambling results.

Each trial began with the presentation of a centrally positioned fixation cross on a computer monitor, which remained onscreen for the duration of the trial. To reduce the number of ocular artifacts, participants were instructed to blink as little as possible and to keep their eyes on the fixation cross at all times. After the fixation cross was presented (500 ± 100 ms), participants were randomly shown one of 180 objects with a value between $5 and $75 CDN (e.g., the aforementioned iPod; for more details, see Turk, van Bussel, Brebner, et al., 2011; Turk, van Bussel, Waiter, et al., 2011). After the object was onscreen for 1,000 ms (±100 ms), a colored frame appeared around the object that cued the participants as to whether or not they (self-gambling trials) or someone else (other-gambling trials) would win/lose the object as a result of a subsequent gamble. The colors of the ownership frames were counterbalanced across participants, and the probability of a trial being a self- or other-ownership trial was set at chance. Following the ownership cue (1,000 ± 100 ms), the fixation cross reappeared and changed color, indicating that participants had to press one of four response buttons to “gamble” for the object. After a brief delay (500 ± 100 ms) following the buttonpress, a feedback stimulus (a word: win/lose) indicated the outcome of the gamble (1,000 ms ± 100 ms). Following the offset of the feedback stimulus, a blank screen was presented for 500 ms. See Fig. 1 for a visual representation of the time line of the experiment.

Participants were instructed to try and win as many prizes as possible. However, unbeknownst to them, the results of the gambles were set at chance for both self- and other-ownership trials; there was a 50 % chance of winning or losing for both self- and other-ownership trials. The purpose of this manipulation was to ensure that the frequency of wins and losses was equivalent over the course of the experiment, in order to avoid contamination of the amplitude of the fERN by stimulus frequency effects (i.e., modulation of the N200 and P300; cf. Holroyd & Krigolson, 2007; Holroyd et al., 2008). Participants completed 10 practice trials at the start of the experiment to gain familiarity with the task. Participants completed 360 trials that were divided between six experimental blocks. As such, each object (see above) was thus shown once for each ownership condition (self, other). Participants relaxed during self-paced rest periods between each block.

Data acquisition

As a behavioral measure, the time to gamble—the time from the onset of the cue to gamble to the time the participant selected a button—was calculated for each trial. The electroencephalogram (EEG) was recorded from 64 electrode locations using BrainVision Recorder software (Version 1.3, Brainproducts, Munich, Germany). The electrodes were mounted in a fitted cap with a standard 10–20 layout and were recorded with an average reference. The vertical and horizontal electrooculograms were recorded from electrodes placed above and below the right eye and on the outer canthi of the left and right eyes, respectively. Electrode impedances were kept below 20 kΩ, with a mean impedance of 7.5 kΩ. The EEG data were sampled at 1000 Hz, amplified (Quick Amp, Brainproducts), and filtered through a pass-band of 0.017–67.5 Hz (90 dB octave roll-off).

Data analysis

The mean time to gamble (in milliseconds) was calculated for each participant for both experimental conditions (self, other). The EEG data were filtered offline through a (0.1- to 20-Hz pass-band) phase shift free Butterworth filter and rereferenced to the average of the two mastoid channels. Next, ocular artifacts were corrected using the algorithm described by Gratton, Coles, and Donchin (1983). Subsequent to this, all trials were baseline corrected using a 200-ms epoch prior to stimulus onset. Finally, trials on which the change in voltage at any channel exceeded 10 uV per sampling point or the change in voltage across the epoch was greater than 100 uV were discarded. In total, less than 5 % of the data were discarded.

Given our hypotheses, ERP waveforms for two events of interest were examined: the ownership cue and the feedback stimulus. To evaluate the effect of ownership, 800-ms epochs of data (starting 200 ms before ownership cue onset) were extracted from the continuous EEG for each trial, channel, and participant for each of the two ownership conditions (self, other). For feedback evaluation, 800-ms epochs of data (starting 200 ms before feedback onset) were extracted from the continuous EEG for each trial, channel, and participant for each of the four feedback outcomes (win self, win other, lose self, lose other). For each of the events of interest, ERP waveforms were created by averaging the epoched EEG data by condition for each electrode, channel, and participant. To quantify and examine ownership and feedback processing, the mean voltage ±25 ms of the peak difference in the grand average waveforms was calculated (ownership, 190–240 ms; feedback, 280–330 ms) at the electrode site where the difference was maximal (FCz).

Both time to gamble and the ERP response to the ownership cue were compared via paired samples t-tests. The impact of ownership on feedback processing was investigated with a 2 (ownership: self, other) × 2 (gambling outcome: win, loss) fully repeated measures analysis of variance (ANOVA). Post hoc decomposition of the interaction term in the ANOVA was done with paired samples t-tests. For all statistical tests, an alpha level of .05 was assumed.

Results

Time to gamble

An examination of the time to gamble—the time from when participants were cued to press one of the four response pad buttons to the time a button was pressed—did not differ between self- and other-ownership trials, p > .05 (self, 520 ± 10 ms; other, 531 ± 10 ms).

Ownership cue

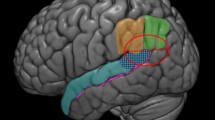

A visual and topographical analysis of the electroencephalographic response to the onset of the self-/other-ownership cue revealed a difference between the self- and other-ownership trials that was maximal over the medial-frontal cortex (peak difference: electrode FCz; see Fig. 2) in the P2/N2 time range (see Fig. 3). Notably, this difference revealed a more positive voltage in the P2/N2 time range for self-ownership (4.80 ± 0.51 uV) as opposed to the other-ownership (3.16 ± 0.46 uV) trials, t(29) = 5.69, p < .001. Given the uniqueness of this particular finding, we then localized the source of the voltage difference between self- and other-ownership cues using standardized low-resolution brain electromagnetic tomography (sLORETA; Pascual-Marqui, 2002). An sLORETA analysis between 190 and 240 ms post-cue-onset indicated maximal current sources in Brodmann area 24, the anterior cingulate cortex (see Fig. 4).

Gamble outcome

An analysis of the ERP waveforms averaged to the onset of the gamble outcome (i.e., win, loss) revealed a component with a timing and scalp topography consistent with previous accounts of the fERN (Miltner et al., 1997; see Fig. 5) for self-ownership gamble outcomes that was not present on other-ownership trials (see Fig. 6). More specifically, we observed an interaction between ownership cue (self, other) and gamble outcome (win, loss), F(1, 29) = 19.57, p < .001. Post hoc decomposition of the interaction via paired samples t-tests demonstrated a more positive ERP response for win (5.01 ± 1.12 uV) than for loss (0.70 ± 0.99 uV) self-ownership trials, t(29) = 7.01, p < .001). No difference was observed between other-ownership win (2.66 ± 1.01 uV) and loss trials (2.02 ± 1.10 uV) (p > .05).

Discussion

In the present study, we found that ownership impacted the amplitude of the fERN, an ERP component reflective of feedback evaluation by a reward-learning system within the medial-frontal cortex (Holroyd & Coles, 2002). More specifically, we found that an fERN was elicited on self-ownership trials—where the “prize” of the participant’s gambles was won or lost by the participant. However, and contrary to this, we did not observe an fERN on other-ownership trials—where the “prize” of the participant’s gambles was won or lost by someone else. As such, our results demonstrate that the medial-frontal reward system is sensitive to perceived ownership; when a gain of utility is for oneself, the medial-frontal system processes this as a gain or a loss. However, when a gain of utility is for someone else, or perhaps for no one at all, the medial-frontal system appears to be insensitive to this and does not differentiate between gains and losses.

Interestingly, we also found a difference in the P2 time range when we contrasted the ERP waveforms for self- and other-ownership cues. Somewhat akin to the fERN, the difference in the P2 had a medial-frontal scalp topography and a timing similar to, albeit earlier than, that for the fERN (see Figs. 2 and 3). Furthermore, and importantly, an sLoreta source analysis put the source of this difference in Brodmann area 24, the anterior cingulate cortex—the source of the error-related negativity (Debener et al., 2005; Miltner et al., 1997). Recent studies have related the P2 to various aspects of reward processing, such as the predictability of the outcome (Polezzi et al., 2008), and studies using magnetoencephalography have found that reward evaluation may commence as early as 230 ms—a time akin to the timing of the difference in the P2 observed in the present experiment (Doñamayor, Marco-Pallarés, Heldmann, Schoenfeld, & Münte, 2011). So, if the difference in the P2 observed here relates to reward processing, what does it mean? One possibility is that self-ownership cues are treated as a potential for gain in utility, whereas other-ownership cues are treated as a potential for loss of utility or, more correctly, are not evaluated in a utilitarian manner. As such, when one contrasts the neural response for self- and other-ownership cues, one observes a difference somewhat akin to the difference reflected in the fERN—a difference due to a difference in reward evaluation within the medial-frontal cortex attributable to the potential for gains and losses.

Together, the aforementioned results demonstrate that the medial-frontal reward system is sensitive to self-relevant (i.e., ownership) outcomes; the processing of wins and losses by this system occurs only if the change in utility is for oneself. The medial-frontal reward system is thought to compute reward prediction error discrepancies between actual and predicted rewards (or losses; Holroyd & Coles, 2002; Holroyd & Krigolson, 2007), and the results of the present study suggest that these computations are undertaken only when gains and losses are experienced by oneself—if the discrepancy between reward and prediction is related to a change in our own utility. While this may at first make our neural systems seem very “selfish,” as was mentioned previously, there is a growing body of evidence that suggests that multiple neural systems are biased when their functional processing is directly relevant to self (Beggan, 1992; Belk, 1988, 1991; Cunningham et al., 2008; Gray et al., 2004; Huang et al., 2009; Turk, van Bussel, Brebner, et al., 2011; Turk, van Bussel, Waiter, et al., 2011; van den Bos et al., 2010). With that said, there is an alternative possibility in the present experiment, and that is that participants did not believe that they were playing for another person at all and, as such, they did not process the wins and losses of other gambles at all.

But what of observational learning? We know that multiple neural systems are sensitive to mistakes made by others; for instance, Bellebaum et al. (2010) demonstrated that an fERN was elicited when participants watched others win and lose money in a gambling task. Bellebaum and colleagues, among others, have proposed that the activity of the medial-frontal reward system when others win or lose money is the potential candidate mechanism that underlies observational learning. At first glance, the results of the present study may appear contradictory to previous findings examining observational learning. However, we propose that that is not the case. Indeed, we propose that during observational learning, one adopts an egocentric, or first-person, view of the observed changes in utility—a transfer in frame of reference in which other people’s mistakes are viewed as one’s own—and as such, the medial-frontal system responds to the viewed feedback in order to improve subsequent performance if one subsequently has to attempt the task one is watching. Indeed, how one views feedback may be the key to determining whether or not observational learning occurs or whether, as is the case here, feedback is viewed in a third-person perspective and the medial-frontal system does not respond. Supporting this hypothesis, it is worth noting that our data are not unique in the failure to elicit an fERN when feedback for another is viewed; at least two observational learning studies have demonstrated a greatly reduced fERN amplitude during “observational learning” conditions (e.g., Fukushima & Hiraki, 2009; Itagaki & Katayama, 2008). Again, it must be noted that the failure to observe an observational learning effect may simply be due to the fact that participants in the present study did not believe that they were playing for another person and, thus, an fERN was not elicited by the results of other gambles.

Conclusions

Here, we have demonstrated that the processing of feedback and ownership cues by the medial-frontal reward system is sensitive to perceived ownership. More specifically, in the present experiment, we demonstrated that the amplitude of the fERN was reduced when wins and losses in a simple gambling task were for someone else. Furthermore, we also demonstrated that the medial-frontal reward system interprets ownership cues for self as a potential for gain and ownership cues for others as a potential for loss. Together, these data are in line with a growing body of evidence that demonstrates that the output of multiple neural systems is reduced when the focus of that output is not oneself.

References

Beggan, J. K. (1992). On the social nature of nonsocial perception: The mere ownership effect. Journal of Personality and Social Psychology, 62(2), 229–237.

Belk, R. W. (1988). Possessions and the extended self. Journal of Consumer Research, 15(2), 139–168.

Belk, R. W. (1991). The ineluctable mysteries of possessions. Journal of Social Behavior and Personality, 6(6), 17–55.

Bellebaum, C., Polezzi, D., & Daum, I. (2010). It is less than you expected: The feedback-related negativity reflects violations of reward magnitude expectations. Neuropsychologia, 48(11), 3343–3350.

Cunningham, S. J., Turk, D. J., Macdonald, L. M., & Neil Macrae, C. (2008). Yours or mine? Ownership and memory. Consciousness and Cognition, 17(1), 312–318.

Debener, S., Ullsperger, M., Siegel, M., Fiehler, K., von Cramon, D. Y., & Engel, A. K. (2005). Trial-by-trial coupling of concurrent electroencephalogram and functional magnetic resonance imaging identifies the dynamics of performance monitoring. Journal of Neuroscience, 25, 11730–11737.

Doñamayor, N., Marco-Pallarés, J., Heldmann, M., Schoenfeld, M. A., & Münte, T. F. (2011). Temporal dynamics of reward processing revealed by magnetoencephalography. Human Brain Mapping, 32(12), 2228–2240.

Fukushima, H., & Hiraki, K. (2009). Whose loss is it? Human electrophysiological correlates of non-self reward processing. Social Neuroscience, 4, 261–275.

Gratton, G., Coles, M. G., & Donchin, E. (1983). A new method for off-line removal of ocular artifact. Electroencephalography and Clinical Neurophysiology, 55(4), 468–484.

Gray, H. M., Ambady, N., Lowenthal, W. T., & Deldin, P. (2004). P300 as an index of attention to self-relevant stimuli. Journal of Experimental Social Psychology, 40(2), 216–224.

Hajcak, G., Holroyd, C. B., Moser, J. S., & Simons, R. F. (2005). Brain potentials associated with expected and unexpected good and bad outcomes. Psychophysiology, 42(2), 161–170.

Hajcak, G., Moser, J. S., Holroyd, C. B., & Simons, R. F. (2006). The feedback-related negativity reflects the binary evaluation of good versus bad outcomes. Biological Psychology, 71(2), 148–154.

Hajcak, G., Moser, J. S., Holroyd, C. B., & Simons, R. F. (2007). It’s worse than you thought: The feedback negativity and violations of reward prediction in gambling tasks. Psychophysiology, 44(6), 905–912.

Hewig, J., Trippe, R., Hecht, H., Coles, M. G. H., Holroyd, C. B., & Miltner, W. H. R. (2007). Decision-making in blackjack: An electrophysiological analysis. Cerebral Cortex, 17(4), 865–877.

Holroyd, C. B., & Coles, M. G. H. (2002). The neural basis of human error processing: Reinforcement learning, dopamine, and the error-related negativity. Psychological Review, 109(4), 679–709.

Holroyd, C. B., & Krigolson, O. E. (2007). Reward prediction error signals associated with a modified time estimation task. Psychophysiology, 44(6), 913–917.

Holroyd, C. B., Krigolson, O. E., & Lee, S. (2011). Reward positivity elicited by predictive cues. NeuroReport, 22(5), 249–252.

Holroyd, C. B., Pakzad-Vaezi, K. L., & Krigolson, O. E. (2008). The feedback correct-related positivity: Sensitivity of the event-related brain potential to unexpected positive feedback. Psychophysiology, 45(5), 688–697.

Huang, Y., Wang, L., & Shi, J. (2009). When do objects become more attractive? The individual and interactive effects of choice and ownership on object evaluation. Personality and Social Psychology Bulletin, 35(6), 713–722.

Itagaki, S., & Katayama, J. (2008). Self-relevant criteria determine the evaluation of outcomes induced by others. Neuroreport, 19, 383–387.

Koban, L., Pourtois, G., Bediou, D., & Vuilleumier, P. (2012). Effects of social context and predictive relevance on action outcome monitoring. Cognitive, Affective, and Behavioral Neuroscience, 12, 460–478.

Kozba, S., Thoma, P., Daum, I., & Bellebaum, C. (2011). The feedback-related negativity is modulated by feedback probability in observational learning. Behavioural Brain Research, 225, 396–404.

Krigolson, O. E., & Holroyd, C. B. (2006). Evidence for hierarchical error processing in the human brain. Neuroscience, 137(1), 13–17.

Krigolson, O. E., & Holroyd, C. B. (2007a). Hierarchical error processing: Different errors, different systems. Brain Research, 1155, 70–80.

Krigolson, O. E., & Holroyd, C. B. (2007b). Predictive information and error processing: The role of medial-frontal cortex during motor control. Psychophysiology, 44(4), 586–595.

Krigolson, O., Holroyd, C., Van Gyn, G., & Heath, M. (2008). Electroencephalographic correlates of target and outcome errors. Experimental Brain Research, 190(4), 401–411.

Krigolson, O. E., Pierce, L. J., Holroyd, C. B., & Tanaka, J. W. (2009). Learning to become an expert: Reinforcement learning and the acquisition of perceptual expertise. Journal of Cognitive Neuroscience, 21(9), 1833–1840.

Mill, J. S. (1879). Of liberty and necessity. System of logic: Ratiocinative and inductive, being a connected view of the principles of evidence and the methods of scientific investigation, Vol 2 (10th ed.). (pp. 421–429). New York: Longmans, Green and Co. doi:10.1037/12840-030

Miltner, W. H. R., Braun, C. H., & Coles, M. G. H. (1997). Event-related brain potentials following incorrect feedback in a time-estimation task: Evidence for a “generic” neural system for error detection. Journal of Cognitive Neuroscience, 9(6), 788–798.

O'Doherty, J. (2004). Reward representations and reward-related learning in the human brain: Insights from human neuroimaging. Current Opinion in Neurobiology, 14(6), 769–76.

Pascual-Marqui, R. D. (2002). Standardized low-resolution brain electromagnetic tomography (sLORETA): Technical details. Methods and Findings in Experimental and Clinical Pharmacology, 24, 5–12.

Polezzi, D., Daum, I., Rubaltelli, E., Lotto, L., Civai, C., Sartori, G., & Rumiati, R. (2008). Mentalizing in economic decision-making. Behavioural Brain Research, 190(2), 218–223.

Schultz, W., Apicella, P., Romo, R., & Scarnati, E. (1995). Context-dependent activity in primate striatum reflecting past and future behavioral events. In Houk, J. C., & Davis, J. L. (Eds.), Models of information processing in the basal ganglia. Cambridge, MA: MIT Press.

Schultz, W., Dayan, P., & Montague, P. R. (1997). A neural substrate of prediction and reward. Science, 275(5306), 1593–1599.

Shane, M. S., Stevens, M., Harenski, C. L., & Kiehl, K. A. (2008). Neural correlates of the processing of another’s mistakes: A possible underpinning for social and observational learning. NeuroImage, 42(1), 450–459.

Sutton, R. S., & Barto, A. G. (1998). Reinforcement learning: An introduction. MIT Press. Cambridge, MA

Turk, D. J., van Bussel, K., Brebner, J. L., Toma, A. S., Krigolson, O., & Handy, T. C. (2011). When “it” becomes “mine”: Attentional biases triggered by object ownership. Journal of Cognitive Neuroscience, 23(12), 3725–3733.

Turk, D. J., van Bussel, K., Waiter, G. D., & Macrae, C. N. (2011). Mine and me: Exploring the neural basis of object ownership. Journal of Cognitive Neuroscience, 23(11), 3657–3668.

van den Bos, M., Cunningham, S. J., Conway, M. A., & Turk, D. J. (2010). Mine to remember: The impact of ownership on recollective experience. The Quarterly Journal of Experimental Psychology, 63(6), 1065–1071.

van Schie, H. T., Mars, R. B., Coles, M. G. H., & Bekkering, H. (2004). Modulation of activity in medial frontal and motor cortices during error observation. Nature Neuroscience, 7, 549–554.

Yeung, N., & Sanfey, A. G. (2004). Independent coding of reward magnitude and valence in the human brain. The Journal of Neuroscience, 24(28), 6258–6264.

Acknowledgments

The first and second authors would like to acknowledge funding from the National Science and Engineering Research Council of Canada that helped support this research.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Krigolson, O.E., Hassall, C.D., Balcom, L. et al. Perceived ownership impacts reward evaluation within medial-frontal cortex. Cogn Affect Behav Neurosci 13, 262–269 (2013). https://doi.org/10.3758/s13415-012-0144-4

Published:

Issue Date:

DOI: https://doi.org/10.3758/s13415-012-0144-4