Abstract

Consumption of sugar-sweetened beverages (SSBs) has increased worldwide. As public health studies expose the detrimental impact of SSBs, consumer protection and public health advocates have called for increased government control. A major focus has been on restricting marketing of SSBs to children, but many innovative policy options – legally defensible ways to regulate SSBs and support public health – are largely unexplored. We describe the public health, economic, and retail marketing research related to SSBs (including energy drinks). We review policy options available to governments, including mandatory factual disclosures, earmarked taxation, and regulating sales, including placement within retail and food service establishments, and schools. Our review describes recent international initiatives and classifies options available in the United States by jurisdiction (federal, state, and local) based on legal viability.

Similar content being viewed by others

Introduction

For centuries, water has been challenged by other beverages as the drink of choice. Tea and coffee were first, followed by the invention of soda water in the 1760s – the basis for cola beverages in the late 1800s.1 Now beverages sweetened with cane sugar, corn syrup, and the derivatives of the two (collectively ‘sugar’)2 are heavily consumed globally.3

As public health studies began to expose the detrimental impact of sugar-sweetened beverages (SSBs), consumer protection and public health advocates called for increased government control, often focusing on marketing.4 In 2010, the World Health Organization (WHO) proclaimed the marketing of unhealthy products to children an international issue, calling on Member States to act.4 But limiting SSB marketing to children is less feasible in the United States, where ‘commercial speech’ (or advertising) is protected by the First Amendment of the Constitution.

In the United States, commercial speech is amenable to regulation and can be restricted in certain circumstances, most notably in the school environment. A legal basis exists to argue that commercial speech directed at children is misleading and deceptive and thus, not protected by the First Amendment.5 Government restrictions, however, would likely provoke constitutional challenges from industry, resulting in complex litigation and unclear outcomes.

Government may consider alternative policy options to avoid such First Amendment challenges. The US Supreme Court has sanctioned the government's ability to protect and inform consumers by mandating the disclosure of factual information or regulating what US law refers to as conduct, which in this context refers to sales practices.6 We apply the Court's reasoning from other public health contexts (for example, tobacco) to SSBs. Our suggestions address information disparities and access issues in the retail environment. The options we consider may be attractive to other countries seeking to regulate SSBs without or in addition to marketing restrictions.

We describe the public health, economic, and retail marketing research about SSBs (including ‘energy drinks’, when applicable). Several policy options are available to address beverages of public health concern: requiring factual disclosures, earmarked taxation, and regulating the sale and location of such beverages within retail and food service establishments, and schools. We discuss legal viability.

Consumption

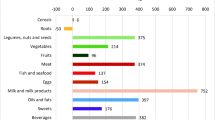

Consumption of SSBs has increased worldwide.7 Soda consumption in the United States peaked in 2000; but new SSBs have emerged. As of 2006, youth SSB consumption had fallen slightly from its all-time high, but adult SSB consumption continues to increase.8 In 2006 youth consumed, on average for each age cohort, from 104 to 269 calories per day from SSBs, rising from age 2 to 18. Adults consumed on average 265–93 calories per day from SSBs, decreasing by age cohort from 19 to 60 and over.8 Global consumption rates are not as high, but are increasing similarly.9, 10

Most SSB consumption occurs in the home environment,11, 12, 13 followed by food service establishments, and schools (for children).11 Greater access to SSBs in schools, and their proximity to fast food establishments result in higher consumption.14

Energy drinks, often studied separately because they are new, are increasingly marketed to and consumed by adolescents and teens.15 Studies in the United States and Germany indicate that 23–34 per cent of adolescents and teens (depending on age and sex) consume energy drinks regularly.15

Many beverages contain caffeine. In the United States 90 per cent of adults report regular caffeine consumption, averaging approximately 280 mg daily and estimates for Europe are higher.16 Youths globally consume caffeine with particularly high intakes in Germany and New Zealand.15 In the United States, adolescents consume an average of 60–70 mg of caffeine daily.15 A recent survey revealed that children aged 5–7 years consume approximately 52 mg of caffeine daily and children 8–12 years consume 109 mg daily.17

Research has documented detrimental health effects from SSBs. The association of SSB consumption and weight gain is stronger than for any other food or beverage.18 SSB intake is associated with dental caries, increased energy intake, overweight, obesity, and is an independent risk factor for diabetes and heart disease.18, 19, 20, 21, 22 Health effect studies on energy drinks find caffeine consumption by youth associated with cardiac abnormalities, caffeine toxicity, and diabetes.15, 17

Retail Environment

Increased SSB consumption world-wide can be attributed to successful marketing, low cost, increased portion sizes, and high availability.3, 18 To induce sales and impulse purchases, retail establishments use price discounts and locate products in check-out aisles, in ‘special displays’, and at the end of aisles.23, 24

The price of SSBs has not kept up with inflation, for decades remaining consistently below the consumer price index.25 Low-income households purchase more SSBs and at lower prices than higher-income households.26 And SSBs cost less in relation to other goods in developing countries than in industrial countries.3

In 2008, to create a report for Congress, the US Federal Trade Commission subpoenaed information from 44 food and beverage companies on marketing practices and expenditures in the United States for 2006. Beverage companies spent US$492 million on youth-directed efforts, with 96 per cent of that amount directed to adolescents.27 Nearly $90 million was spent on teen-directed packaging and in-store marketing for carbonated beverages, by far the largest in-store expenditure. It represented 46 per cent of all youth-directed expenditures for packaging and in-store marketing.27

The WHO recognized ‘a need to ensure that the private sector markets its products responsibly’.4 The US government has encouraged self-regulation,28 and the largest beverage companies globally and in the United States29 are members of a self-regulatory body. The companies pledged to limit their marketing directed at youth in covered media (for example, television) according to internal nutritional guidelines, which notably exclude point-of-sale materials and packaging,30 where beverage companies spend substantially to promote SSBs to youth. Retail promotion remains unregulated.

Most countries, lacking legal protection of commercial speech, can liberally regulate marketing, as the WHO has advised. Most SSB marketing occurs through broadcast media, the internet, in schools, and in retail establishments.27 In Sweden, Norway, and the Canadian province of Quebec broadcast advertising restrictions are in place, but viewers may remain exposed through transmission from other countries.31 We suggest below how countries may regulate SSBs in schools and retail establishments.

National and Multi-National Regulatory Issues and Options

Sugar and caffeine are the two main ingredients of SSBs recognized as potential health concerns.32, 33 The US Food and Drug Administration (FDA) regulates the safety and packaging of food, including beverage products. In the 1970s, the FDA found that added sugar was generally recognized as safe (GRAS) at the levels being consumed at the time, as was caffeine when added to cola-type beverages.34 The agency sets no limit for sugar, but limits caffeine to 71 mg per 12-ounce cola-type drink. Since the FDA granted GRAS status for sugar and caffeine, the consumption of soft drinks has more than doubled and energy drinks have been introduced to the market.32 Added sugar consumption has doubled for most of the population,35 and almost tripled for teens, due largely to increased SSB intake.11, 12, 32

Energy drinks contain more sugar and as much as three times the amount of caffeine as other SSBs of the same size, and they are also sold in larger, non-resealable containers.36 A non-resealable soft drink is usually 12 ounces, while energy drinks come in 16 and 24 ounce cans, which contain more than 90 g of sugar and 240–500 mg of caffeine.36

Manufacturers of energy drinks often designate the products as dietary supplements and not beverages. As such, they fall under the regulatory guidelines of 1994 Dietary Supplement Health and Education Act, giving the FDA less regulatory control than under the Food Drug and Cosmetic Act.37 The FDA has not enforced caffeine limitations for soft drinks, but if the agency were to regulate SSBs, its limits would not apply to energy drinks self-designated as dietary supplements, unless the agency were to redefine the category.38 In December 2009, the FDA issued Guidance to Industry expressing concern that liquids are increasingly being marketed as dietary supplements instead of as beverages, but has taken no action since.39

In 1990, the US Congress passed the Nutrition Labeling and Education Act, which requires that total sugar, but not caffeine content, be disclosed on labels of beverages and dietary supplements.40 (Some manufacturers disclose caffeine voluntarily.) The FDA has the authority to require scientifically based warning labels on SSBs, similar to the Surgeon General's warning on tobacco products.41

In the EU, sugar disclosure is voluntary, unless a nutrient claim is made on packaging or in advertising, in which case it becomes mandatory. The EU does not require caffeine content be disclosed on cola-type beverages, but if the beverage contains caffeine in excess of 150 mg/l, the message, ‘High caffeine content’, must appear on the label.42

Recommendations for added sugar and caffeine consumption vary globally, but few countries have strong or quantitative recommendations. Governments may enact legal restrictions on the permissible quantity of sugar or caffeine in beverages and energy drinks,43 or seek voluntary reductions. In 2010, the UK Food Standards Agency, for example, recommended that SSB manufacturers reduce added sugar by 4 per cent by 2012.44 The newly elected Conservative government withdrew this recommendation.

Regulation through Taxation

Many countries use taxation to reduce consumption of unhealthy products.45 For example, high tobacco taxes decrease purchases. Studies suggest similar results could be achieved with high taxes on SSBs.26 SSB taxes to regulate conduct and improve health are now being seriously considered as obesity rates continue to threaten public health and the economic downturn makes taxation an attractive source of revenue.

Three Pacific Islands – Samoa, Nauru, and French Polynesia – have imposed SSB taxes for health-related purposes. They report increased revenue and decreased consumption.46 In Samoa and Nauru, the availability of less expensive bottled water may have contributed to reductions in sweetened drink consumption.46 Several US states and cities, including Hawaii,47 Kansas48 and Philadelphia,49 attempted to pass SSB taxes, unsuccessfully. In the United States, the federal government, states, and some cities have the power to tax SSBs.6

Advocates have encouraged excise taxes25 – defined as ‘a duty or impost levied upon the manufacture, sale or consumption of commodities’.50 An excise tax would be imposed on the beverage or syrup manufacturer, in contrast to a sales tax that is imposed on the retail purchase price. Excise taxes are easier to enforce and collect, and would apply to all beverages with added sugars, including energy drinks. An excise tax increases the base price of the product. In contrast, a sales tax is imposed at time of payment, which occurs after most consumers have decided to purchase the product. This encourages the purchase of larger containers, and would not impact the cost of free refills.25

There is no guarantee that manufacturers will pass on the excise tax, but other positive outcomes could result. Manufacturers could increase the price of all products, decrease portion sizes, decrease sugar in products, absorb the tax or pass it on to consumers. In the Pacific Islands, large revenues were reported but there were insufficient data to calculate the impact of SSB taxes on population consumption.46

For tobacco, manufacturers use trade discounts, coupons, and other promotions to counteract the effects of excise taxes.51 To establish a minimum price at which SSBs can be sold to consumers, countries and states can institute minimum price laws and expressly prohibit trade discounts.51 In the United States, minimum price laws coupled with an express prohibition on trade discounts, result in higher prices to discourage tobacco purchase.

An excise tax is amenable to earmarking, where the revenue is dedicated to a specific purpose.52 Earmarking for a popular cause can help legislators pass an unpopular tax.46 For SSB taxes, earmarking to support public health programs, such as obesity prevention, can mitigate concerns about the regressivity of taxing low-income consumers. Program proponents favor earmarking because it can ensure continuous funding, although depending on the revenue source, funding may fluctuate and decline over time.52

Excise Taxes and Earmarking in the United States

An excise tax on SSBs would have the dual purposes of reducing consumption and raising revenue – where a fraction might be earmarked for public health. In the United States, the first excise tax was enacted on whiskey, just 2 years after the Constitution was ratified.50 The tax was specifically proposed to diminish consumption.53 The US Supreme Court has confirmed that taxation remains legitimate even if implemented specifically to deter behavior.54

The Federal government imposes excise taxes on a wide variety of products including alcohol, tobacco, fuel, and vaccines.50 They represent a significant revenue stream for the government,50 and many are earmarked for programs such as health, education, and the environment.55 An excise tax on coal, for example, is dedicated for the Black Lung Disability Benefits Trust Fund to pay health benefits for miners.56

Both the federal and state governments can impose excise taxes on SSBs. Every state earmarks specific taxes, averaging 24 per cent of total collections in 2005 – 4.4 per cent (Rhode Island) to 84 per cent (Alabama).55 All 50 states and District of Columbia impose excise taxes on tobacco products,57 and as of 2005, 26 states earmarked them.55

The ability of local governments to impose taxes is limited according to the authority granted to them by the state constitution and legislature. Some local jurisdictions can tax only specific products or services;58 others need permission from the state government or its constituency to impose a tax.59 Some have the authority to impose other revenue generating measures, such as fees60 or business privilege taxes.61 Where permitted, SSBs may be taxed in this way.

Note that sales taxes vary among states, with some exempting SSBs as a food, and others imposing a sales tax only in vending machines.62, 63 Because SSBs are not seen as necessities like other food, states might consider abolishing their exemption from sales taxes.

Regulation of the Retail Environment

In the United States, state and local (collectively ‘state’) governments have the power to regulate the sale and location of products within retail and food service establishments, consistent with their power to address public health, safety, and welfare. The Supreme Court has provided specific suggestions available to states seeking to protect the public from harmful products, including directly banning the product,6 limiting per capita purchases,6 prohibiting the purchase by minors,64 and implementing specific restrictions on sales such as requiring harmful products to be placed in specific areas,64 and by extension, sold in specific places. Many such policy options are also available to countries worldwide. We consider each in turn.

It is unlikely that a government would ban all sugary drinks (unlike recent bans on caffeinated alcoholic beverage in several US states),65 but some countries and states have banned or negotiated with companies to remove from retail sale specific beverages that may pose a public health risk. France, Denmark, and Norway banned ‘Red Bull’, but the European Court of Justice held that without evidence of a health risk, a ban was an improper trade restriction.66 The former Connecticut Attorney General negotiated with a company that produced the energy drink, ‘Cocaine’, to remove the product from the state.67 In the United States, such bans can also be initiated by legislation.

Limitations on how much of a harmful product an individual may buy were instituted for drug products containing pseudoephedrine.68 In the context of SSBs, this would more practically take the form of a serving size restriction, because containers may be purchased for multiple users or for future consumption. States can restrict the sale of portion sizes over a certain number of ounces. Extra large drinks offered in some fast food restaurants, like the Big Gulp at the convenience store chain, 7-Eleven, contain 64 ounces and up to 880 calories and 232 g of sugar.69 A state could restrict the ability of food service establishments to offer such large single serving beverages. In Oregon, a bill was proposed to prohibit the sale of pre-packaged, single-serving SSBs in containers larger than 12 ounces.70 For energy drinks, the government might restrict the size of non-resealable containers or institute per capita restrictions on the sale of energy drinks in large non-resealable containers.

The suggestions above might be combined with an age restriction, so that they would apply only to youth under a certain age. Age restrictions on purchases of tobacco, alcohol, and other products vary internationally. In the United States, every jurisdiction prohibits tobacco sales to minors.57 Minimum age requirements to purchase certain beverages are legally possible as well. In 2010, a New York county legislator proposed a ban on the sale of energy drinks to minors less than 19 years old.71

State governments can also regulate the location of products within or by the type of retail establishment. Laws often require tobacco and pharmaceuticals to be placed behind the sales counter (not on open shelves). More politically feasible than placing SSBs behind the counter would be to require that they be placed in the back of the store, and removed from special displays and check-out aisles.

State governments can also restrict where products are sold. Forty-six states and the District of Columbia restrict the sale of tobacco products in vending machines.57 San Francisco successfully banned the sale of tobacco products in pharmacies.72 SSBs are widely available in vending machines,62 pharmacies,73 and schools.74 The government might restrict SSBs, or those not meeting a certain nutritional requirement, from being sold in these venues. School authorities can also institute a ban on the sale of SSBs on school grounds or contract with industry to remove them from their product offerings.75 (Local government can support school officials by instituting zoning requirements that prevent fast food restaurants from locating near schools.)76

Many locales license tobacco vendors, obliging them to meet certain conditions. In New York City, for example, tobacco vendors must obtain a license conditioned on the agreement that they will not sell cigarettes out of the package.77 As part of a conditional license, state governments could require SSB vendors to agree to the regulations suggested above, in addition to other requirements, such as placing point of purchase warning signs at the check-out. This would mimic the Surgeon General's warning on tobacco products but in a sign format placed near the point of purchase. In the United States, the government should require factual statements, such as scientifically based health warnings, or calorie, sugar, and caffeine disclosures, so as not to raise First Amendment concerns.

Conclusion

The concept of regulating SSBs is gaining momentum globally and many countries and regions are considering or have proposed innovative solutions. As research continues to support action and political and social norms change, the policy options we have discussed are worthy of consideration.

Countries and regions have their own legal and political barriers to enacting SSB regulations, but industry efforts to prevent regulation seem consistent globally. Governments and advocates can share lessons,46 review past hearing testimony to anticipate industry arguments,78 and learn from each others’ experiences.49 SSBs are ‘non-necessities’ associated with a decline in health. Many policy options are available to governments seeking to improve health, decrease health-care expenditures, and generate revenue.

References

Standage, T. (2006) A History of the World in 6 Glasses. New York: Walker Publishing Company.

21 C.F.R. § 186.1275 (1975); 21 C.F.R. §§ 184.1854, 184.1857, 184.1859, 184.1865 (1976).

The Economist. (2008) Africa and Coca-Cola: Index of happiness? 3 July, p. 1, http://www.economist.com/node/11670946, accessed 17 March 2011.

WHO. (2010) Set of recommendations on the marketing of foods and non-alcoholic beverages to children (resolution WHA63.14). 21 May, http://www.who.int/dietphysicalactivity/publications/recsmarketing/en/index.html, accessed 17 March 2011.

Pomeranz, J.L. (2010) Television food marketing to children revisited: The federal trade commission has the constitutional and statutory authority to regulate. Journal of Law Medicine and Ethics 38: 98–116.

44 Liquormart Inc. v. Rhode Island, 517 US 484 (1996).

Popkin, B.M. and Nielsen, S.J. (2003) The sweetening of the world's diet. Obesity Research 11: 1325–1332.

Popkin, B.M. (2010) Patterns of beverage use across the lifecycle. Physiology & Behavior 100: 4–9.

Nissinena, K. et al (2009) Sweets and sugar-sweetened soft drink intake in childhood in relation to adult BMI and overweight. The cardiovascular risk in young Finns study. Public Health Nutrition 12: 2018–2026.

Gibson, S. and Neate, D. (2007) Sugar intake, soft drink consumption and body weight among British children: Further analysis of National Diet and Nutrition Survey data with adjustment for under-reporting and physical activity. International Journal of Food Sciences and Nutrition 58 (6): 445–460.

Nielsen, S.J. and Popkin, B.M. (2004) Changes in beverage intake between 1977 and 2001. American Journal of Preventive Medicine 27 (3): 205–210.

Wang, Y.C., Bleich, S.N. and Gortmaker, S.L. (2008) Increasing caloric contribution from sugar-sweetened beverages and 100% fruit juices among US children and adolescents, 1988–2004. Pediatrics 121: e1604–e1614.

Ezendam, N.P., Evans, A.E., Stigler, M.H., Brug, J. and Oenema, A. (2010) Cognitive and home environmental predictors of change in sugar-sweetened beverage consumption among adolescents. The British Journal of Nutrition 103 (5): 768–774.

Davis, B. and Carpenter, C. (2009) Proximity of fast-food restaurants to schools and adolescent obesity. American Journal of Public Health 99 (3): 505–510.

Seifert, S.M., Schaechter, J.L., Hershorin, E.R. and Lipshultz, S.E. (2011) Health effects of energy drinks on children, adolescents, and young adults. Pediatrics 127: 511–528.

Juliano, L.M. and Griffiths, R.R. (2004) A critical review of caffeine withdrawal: Empirical validation of symptoms and signs, incidence, severity, and associated features. Psychopharmacology 176: 1–29.

Warzak, W.J., Evans, S., Floress, M.T., Gross, A.C. and Stoolman, S. (2011) Caffeine consumption in young children. The Journal of Pediatrics 158 (3): 508–509.

Woodward-Lopez, G., Kao, J. and Ritchie, L. (2010) To what extent have sweetened beverages contributed to the obesity epidemic? Public Health Nutrition 23: 1–11.

Heller, K.E., Burt, B.A. and Eklund, S.A. (2001) Sugared soda consumption and dental caries in the United States. Journal of Dental Research 80: 1949–1953.

Malik, V.S., Popkin, B.M., Bray, G.A., Despres, J.-P. and Hu, F.B. (2010) Sugar-sweetened beverages, obesity, type 2 diabetes mellitus, and cardiovascular disease risk. Circulation 121 (11): 1356–1364.

Ludwig, D., Peterson, K. and Gortmaker, S. (2001) Relation between consumption of sugar-sweetened drinks and childhood obesity; a prospective, observational analysis. Lancet 357: 505–508.

Malik, V.S., Schulze, M.B. and Hu, F.B. (2006) Intake of sugar-sweetened beverages and weight gain: A systematic review. American Journal of Clinical Nutrition 84: 274–288.

Wilkinson, J.B., Mason, J.B. and Paksoy, C.H. (1982) Assessing the impact of short-term supermarket strategy variables. Journal of Marketing Research 19: 72–86.

Inman, J.J., Winer, R.S. and Ferraro, R. (2009) The interplay among category characteristics, customer characteristics, and customer activities on in-store decision making. Journal of Marketing 73 (5): 19–29.

Brownell, K.D. and Frieden, T.R. (2009) Ounces of prevention – The public policy case for taxes on sugared beverages. New England Journal of Medicine 360 (18): 1805–1808.

Finkelstein, E.A., Zhen, C., Nonnemaker, J. and Todd, J.E. (2010) Impact of targeted beverage taxes on higher- and lower-income households. Archives of Internal Medicine 170 (22): 2028–2034.

FTC. (2008) FTC Report: Marketing food to children and adolescents. July, http://www.ftc.gov/os/2008/07/P064504foodmktingreport.pdf, accessed 15 March 2011.

Majoras, D.P. (2005) The Federal Trade Commission: fostering positive market initiatives to combat obesity. Presentation at Obesity Liability Conference; 11 May, Chicago, IL.

Fortune. (2010) Global 500: Annual ranking of the world's largest companies, http://money.cnn.com/magazines/fortune/global500/2010/full_list/index.html, accessed 15 March 2011.

Better Business Bureau. (2010) Company pledges, http://www.bbb.org/us/children-food-beverage-advertising-initiative/pledges/.

Institute of Medicine. (2006) Food Marketing to Children and Youth: Threat or Opportunity? Washington, DC: The National Academies Press, p. 354.

American Heart Association. (2009) Dietary sugars intake and cardiovascular health: A scientific statement from the American Heart Association. Circulation 120: 1011–1020.

O'Connor, E. (2001) A sip into dangerous territory. Monitor on Psychology 32 (6), http://www.apa.org/monitor/jun01/dangersip.aspx.

21 C.F.R. § 182.1180.

Bray, G.A., Nielsen, S.J. and Popkin, B.M. (2004) Consumption of high-fructose corn syrup in beverages may play a role in the epidemic of obesity. The American Journal of Clinical Nutrition 79 (4): 537–543.

Reissig, C.J., Strain, E.C. and Griffiths, R.R. (2009) Caffeinated energy drinks – A growing problem. Drug and Alcohol Dependence 99: 1–10.

Van Dusen, A. (2008) Know what's in your energy drink? Forbes.com September, http://www.forbes.com/2008/09/23/energy-caffeine-drink-forbeslife-cx_avd_0924health.html, accessed 3 May 2011.

FDA. (2009) Overview of dietary supplements, http://www.fda.gov/Food/DietarySupplements/ConsumerInformation/ucm110417.htm, accessed 3 May 2011.

FDA. (2009) Guidance for industry: Factors that distinguish liquid dietary supplements from beverages, considerations regarding novel ingredients, and labeling for beverages and other conventional foods. December, http://www.fda.gov/Food/GuidanceComplianceRegulatoryInformation/GuidanceDocuments/ucm192702.htm, accessed 4 May 2011.

62 F.R. 49826.

Milavetz v. United States, 130 S. Ct. 1324 (2010).

The Commission of the European Communities. (2002) Commission Directive on the labelling of foodstuffs containing quinine, and of foodstuffs containing caffeine. (2002/67/EC) 18 July, http://eur-lex.europa.eu/pri/en/oj/dat/2002/l_191/l_19120020719en00200021.pdf, accessed 18 March 2011.

Rubin v. Coors Brewing Co., 514 US 476 (1995).

Halliday, J. (2010) New goals set for sugar and saturated fat reduction, Foodnavigator.com 29 March, http://www.foodnavigator.com/Legislation/New-goals-set-for-sugar-and-saturated-fat-reduction, accessed 18 March 2011.

Bouckley, B. (2011) Danish food industry sources slam ‘fat tax’, FoodNavigator.com 14 January, http://www.foodnavigator.com/Legislation/Danish-food-industry-sources-slam-fat-tax, accessed 17 March 2011.

Thow, A.M., Quested, C., Juventin, L., Kun, R., Khan, A.N. and Swinburn, B. (2010) Taxing soft drinks in the Pacific: Implementation lessons for improving health. Health Promotion International 26 (1): 55–64.

HI HB 1062.

KS SB 567.

Shields, J. (2011) Big beverage gives $10 million to CHOP, http://www.Philly.com, 16 March, http://www.philly.com/philly/blogs/heardinthehall/118077483.html, accessed 17 March 2011.

CCH Editorial Staff Publication. (2008) Introduction. In: D. Becker (ed.) US Master Excise Tax Guide Sixth Edition. Chicago, IL: CCH Editorial Staff Publication.

Ribisl, K.M., Patrick, R., Eidson, S., Tynan, M. and Francis, J. (2010) CDC Morbidity and Mortality Weekly Report. 9 April, State Cigarette Minimum Price Laws- United States 2009 59 (13): 389–392, http://www.cdc.gov/mmwr/preview/mmwrhtml/mm5913a2.htm, accessed 15 March 2011.

Stocker, F. and Maguire, S. (2005) Earmarking of taxes. In: J.J. Cordes, R.D. Ebel and J. Gravelle (eds.) Encyclopedia of Taxation and Tax Policy, 2nd edn. Washington, DC: Urban Institute, pp. 89–90.

Simon, S. (1950) Alexander Hamilton and the whiskey tax. Alcohol and tobacco tax and trade bureau. US department of treasury, http://www.ttb.gov/public_info/special_feature.shtml, accessed 15 March 2011.

US v. Sanchez, 340 US 42.

Perez, A. (2008) National conference of state legislatures. Earmarking State Taxes. September.

CCH Editorial Staff Publication. (2008) Manufacturers taxes. In: D. Becker (ed.) US Master Excise Tax Guide Sixth Edition. Chicago, IL: CCH Editorial Staff Publication, p. 138.

American Cancer Society. (2006) State legislated action on tobacco. 6 October.

New York Code § 1201 (2006).

California Constitution Art. XIII A, Sec. 4.

Sinclair Paint Company v. State Board of Equalization, 15 Cal.4th 866 (1997).

53 Pennsylvania Statutes § 6924.311 (2010).

Chriqui, J.F., Eidson, S.S., Bates, H., Kowalczyk, S. and Chaloupka, F.J. (2008) State sales tax rates for soft drinks and snacks sold through grocery stores and vending machines, 2007. Journal of Public Health Policy 29: 226–249.

AZ Administrative Code R15-5-1860 (1980).

Lorillard Tobacco Co. v. Reilly, 533 US 525 (2001).

Noorbaloochi, S. (2010) Massachusetts becomes fourth state to ban Four Loko. Epic Times 22 November, http://www.theepochtimes.com/n2/content/view/46332/, accessed 15 March 2011.

Palmer, D. (2008) France reluctantly lifts ban on Red Bull. Australian Food News 17 July, http://www.ausfoodnews.com.au/2008/07/17/france-reluctantly-lifts-ban-on-red-bull.html, accessed 17 March 2011.

Connecticut Attorney General's Office. (2007) Attorney General, DCP Commissioner announce agreement banishing ‘Cocaine’ drink from CT stores. 7 May, http://www.ct.gov/AG/cwp/view.asp?A=2788&Q=379504, accessed 15 March 2011.

Idaho Code § 37-3303 (2009).

Rudd Center Fast Food FACTS. (2010) http://www.fastfoodmarketing.org, accessed 15 March 2011.

OR HB 3222 (2011).

Epstein, R.J. (2010) Under 19? Suffolk bill could ban Red Bull. Newsday 8 December, http://www.newsday.com/long-island/suffolk/under-19-suffolk-bill-could-ban-red-bull-1.2527343, accessed 15 March 2011.

Philip Morris v. City & County of San Francisco, 345 Fed. Appx. 276 (9th Cir. 2009).

Eder, R. (2003) New products with staying power are packing drug's beverage aisle. Drug Store News 25 (5): 19, 7 April.

CDC. (2001) Children's Food Environment State Indicator Report, 2011, http://www.cdc.gov/obesity/downloads/ChildrensFoodEnvironment.pdf, accessed 4 May 2011.

Mello, M.M., Pomeranz, J. and Moran, P. (2008) The interplay of public health law and industry self-regulation: the case of sugar-sweetened beverage sales in schools. American Journal of Public Health 98 (4): 595–604.

Mair, J.S., Pierce, M. and Teret, S.P. (2005) The use of zoning to restrict fast food outlets: A potential strategy to combat obesity. Monograph: Center for Law and the Public's Health at Johns Hopkins & Georgetown Universities, http://www.publichealthlaw.net/Zoning%20Fast%20Food%20Outlets.pdf.

New York Laws: New York City Administrative Code: Tobacco Product Regulation Act. §§17-616 – 17-626.

Hawaii State Legislature. (2011) Testimony SB 1179 sugar-sweetened beverages tax, http://www.capitol.hawaii.gov/session2011/getstatus.asp?query=SB1179&currpage=1&showstatus=on&showtestimony=on, accessed 20 March 2011.

Author information

Authors and Affiliations

Additional information

The author explores what laws and strategies could be used to regulate marketing of sugar-sweetened beverages more effectively because these affect consumer behavior and thus obesity.

Rights and permissions

About this article

Cite this article

Pomeranz, J. Advanced policy options to regulate sugar-sweetened beverages to support public health. J Public Health Pol 33, 75–88 (2012). https://doi.org/10.1057/jphp.2011.46

Published:

Issue Date:

DOI: https://doi.org/10.1057/jphp.2011.46