Abstract

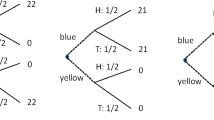

We investigate the evaluation of known (where probability is known) and unknown (where probability is unknown) bets in comparative and non-comparative contexts. A series of experiments support the finding that ambiguity avoidance persists in both comparative and non-comparative conditions. The price difference between known and unknown bets is, however, larger in a comparative evaluation than in separate evaluation. Our results are consistent with Fox and Tversky's (1995) Comparative Ignorance Hypothesis, but we find that the strong result obtained by Fox and Tversky is more fragile and the complete disappearance of ambiguity aversion in non-comparative condition may not be as robust as Fox and Tversky had supposed.

Similar content being viewed by others

References

Becker, S. W. and F. O. Brownson. (1964). “What Price Ambiguity? Or the Role of Ambiguity in Decision Making,” Journal of Political Economy 72, 62–73.

Becker, G. M., M. H. DeGroot, and J. Marshak. (1964). “Measuring Utility by a Single Response Sequential Method,” Behavioral Science 9, 226–232.

Boiney, L. (1993). “The Effects of Skewed Probability on Decision Making under Ambiguity,” Organizational Behavior and Human Decision Processes 56, 134–148.

Camerer, C. and M. Weber. (1992). “Recent Developments in Modeling Preferences: Uncertainty and Ambiguity,. Journal of Risk and Uncertainty 5, 325–370.

Curley, S. P. and F. J. Yates. (1985). “The Center and Range of the Probability Interval as Factors Affecting Ambiguity Preferences,” Organizational Behavior and Human Decision Processes 36, 272–287.

Ellsberg, D. (1961). “Risk, Ambiguity, and the Savage Axioms,” Quarterly Journal of Economics 75, 643–669.

Fox, C. R. and A. Tversky. (1995). “Ambiguity Aversion and Comparative Ignorance,” The Quarterly Journal of Economics 110, 585–603.

Heath, C. and A. Tversky. (1991). “Preference and Belief: Ambiguity and Competence in Choice Under Uncertainty,” Journal of Risk and Uncertainty 4, 5–28.

Hogarth, R. M. and H. Kunreuther. (1988). “Risk, Ambiguity, and Insurance,” Journal of Risk and Uncertainty 2, 5–35.

Hsee, C. K. (1996). “The Evaluability Hypothesis: An Explanation of Preference Reversals between Joint and Separate Evaluations of Alternatives,” Organizational Behavior and Human Decision Processes 67, 247–257.

Hsee, C. K., G. F. Lowenstein, S. Blount, and M. H. Bazerman. (1999). “Preference Reversals Between Joint and Separate Evaluations of Options: A Review and Theoretical Analysis,” Psychological Bulletin 125, 576–590.

Kahn, B. E. and R. K. Sarin. (1988). “Modeling Ambiguity in Decisions Under Uncertainty,” Journal of Consumer Research 15, 265–272.

Knight F. H. (1921). Risk, Uncertainty, and Profit. University of Chicago Press, Chicago.

Keynes, J. M. (1921). A Treatise on Probability, London, Macmillan.

MacCrimmon, K. R. (1965). “An Experimental Study of the Decision Making Behavior of Business Executives,. Ph.D. Dissertation, UCLA.

MacCrimmon, K. R. and S. Larsson. (1979). “Utility Theory: Axioms Versus Paradoxes.” In M. Allais and O. Hagen (eds.), Expected Utility Hypotheses and the Allais Paradox, Boston, Reidel.

Sarin, R. K. and M. Weber. (1993). “Effects of Ambiguity in Market Experiments,” Management Science 39, 603–615.

Slovic, P. and A. Tversky. (1974). “Who Accepts Savage's Axiom?,” Behavioral Science 19, 368–373.

Viscusi, W. K. and H. Chesson. (1999). “Hopes and Fears: The Conflicting Effects of Risk Ambiguity,” Journal of Risk and Uncertainty 47, 153–178.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Chow, C.C., Sarin, R.K. Comparative Ignorance and the Ellsberg Paradox. Journal of Risk and Uncertainty 22, 129–139 (2001). https://doi.org/10.1023/A:1011157509006

Issue Date:

DOI: https://doi.org/10.1023/A:1011157509006