Abstract

We conduct experiments to analyze investment behavior in decisions under risk. Subjects can bet on the outcomes of a series of coin tosses themselves, rely on randomized ‘experts’, or choose a risk-free alternative. We observe that subjects who rely on the randomized experts pick those who were successful in the past, showing behavior consistent with the hot hand belief. Obviously the term ‘expert’ suffices to attract some subjects. For those who decide on their own, we find behavior consistent with the gambler’s fallacy, as the frequency of betting on heads (tails) decreases after streaks of heads (tails).

Similar content being viewed by others

References

Ayton P., Fischer I. (2004) The hot hand fallacy and the gambler’s fallacy: two faces of subjective randomness?. Memory and Cognition 32: 1369–1378

Bachelier L. (1900) Théorie de la Spéculation. Gauthier Villars, Paris

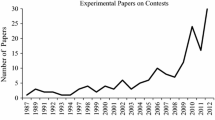

Bar-Eli M., Avugos S., Raab M. (2006) Twenty years of “hot hand” research: review and critique. Psychology of Sport and Exercise 7: 525–553

Carhart M.M. (1997) On persistence in mutual fund performance. The Journal of Finance 52: 57–82

Caruso, E. M., & Epley, N. (2004). Hot hands and cool machines: perceived intentionality in the predictions of streaks. Poster session presented at the 5th Annual Meeting of the Society for Personality and Social Psychology, Austin, TX, USA.

Croson R., Sundali J. (2005) The Gambler’s fallacy and the Hot hand: empirical data from casinos. The Journal of Risk and Uncertainty 30(3): 195–209

Dohmen, T. J., Falk, A., Huffman, D., Schupp, J., Sunde, U., & Wagner, G. G. (2006). Individual risk attitudes: New evidence from a large, representative, experimentally-validated survey. CEPR Discussion Paper No. 5517.

Estes W.K. (1964) Probability learning. In: Melton A.W.(eds) Categories of human learning. Academic Press, New York, London

Fama E.F. (1970) Efficient capital markets: A review of theory and empirical work. The Journal of Finance 45: 383–417

Fama E.F. (1991) Efficient capital markets II. The Journal of Finance 66: 1575–1616

Fischbacher U. (2007) z-Tree: Zurich toolbox for ready-made economic experiments. Experimental Economics 10: 171–178

Jensen M.C. (1968) The performance of mutual funds in the period 1945–1964. The Journal of Finance 23: 389–416

Jörgensen, C. B. (2006). Field evidence on the law of small numbers. Working Paper.

Kahneman D., Tversky A. (1979) Prospect theory: An analysis of decision under risk. Econometrica 47: 263–291

Malkiel B.G. (2005) Reflections on the efficient market hypothesis: 30 years later. The Financial Review 40: 1–9

Nickerson R.S. (2004) Cognition and chance: The psychology of probabilistic reasoning. Lawrence Erlbaum Associates Inc, Mahwah, NJ

Odean T. (1998) Are investors reluctant to realize their losses?. The Journal of Finance 53: 1775–1798

Rabin M. (2002) Inference by believers in the law of small numbers. The Quarterly Journal of Economics 117: 775–816

Rapoport A., Budescu D. (1997) Randomization in individual choice behavior. Psychology: Review 104: 603–617

Rieskamp J. (2006) Positive and negative regency effects in retirement saving decisions. Journal of Experimental Psychology: Applied 12: 233–250

Shapira Z., Venezia I. (2001) Patterns of behavior of professionally managed and independent investors. Journal of Banking & Finance 25: 1573–1587

Sirri E.R., Tufano P. (1998) Costly search and mutual fund flows. The Journal of Finance 53: 1589–1622

Sundali J., Croson R. (2006) Biases in casino betting: The hot hand and the Gambler’s fallacy. Judgment and Decision Making 1: 1–12

Tversky A., Kahneman D. (1971) Belief in the Law of Small Numbers. Psychological Bulletin 76: 105–110

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Huber, J., Kirchler, M. & Stöckl, T. The hot hand belief and the gambler’s fallacy in investment decisions under risk. Theory Decis 68, 445–462 (2010). https://doi.org/10.1007/s11238-008-9106-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11238-008-9106-2