Abstract

R&D investment and growth in SMEs and large firms relate in a complex way. This paper analyses what role persistence of innovation output plays in shaping that relationship. We apply a vector auto-regression model to Finnish firm-level data and summarize the lead–lag relationship and complex co-movements of R&D growth and firm growth series. We found only continuous product and process innovators to have positive associations between R&D growth and sales growth. Also the associations between sales growth and subsequent R&D growth were stronger for continuous innovators than for occasional innovators, but only for product innovators. In the case of process innovators it is the occasional innovators that exhibit a stronger association between sales growth and subsequent R&D growth. In addition, our results vary between large and small firms. We express the need for further research on innovation dynamics and growth of SMEs analysing the interactions between different innovation activities.

Similar content being viewed by others

Notes

Following Raymond et al. (2010) we restrict the sample to firms that have at least two consecutive observations in the bi-annual CIS survey as to be able to define each firm in our sample as either being an occasional or continuous innovator.

Insignificant numbers refer to employment smaller than 1 and total R&D expenditures and sales smaller than 1,000 Euro.

R&D intensity is defined as the sum of internal and external R&D expenditures as a share of total sales.

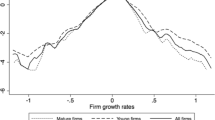

As Coad (2010) points out although the “Nickel-bias” is often observed to be small (Nickell 1981) it could indeed be dealt with by using IV techniques such as GMM (Blundell and Bond 1998). The problem here is that it is difficult to find suitable instruments for growth rates because they are in nature random and lack persistence (Geroski 2000). IV estimates of a panel VAR with weak instruments thus leads to imprecise estimates. Binder et al. (2005) present a panel VAR model which can include firm-specific effects but that does not require the use of Instrument Variables. The drawback with their model for this particular application is that it assumes normally distributed errors whereas the distribution of firm growth rates are approximately Laplace distributed.

Due to the exploratory nature of our reduced VAR-model this should not be considered as a draw-back.

With “asymmetry result” we here refer to the finding that declining firms do not decrease R&D expenditure with the same ease that growing firms can increase R&D expenditure.

References

Acs, Z. J., & Audretsch, D. B. (1990). Innovation and small firms. Cambridge, MA: MIT Press.

Arthur, W. B. (1988). Competing technologies. In G. Dosi, C. Freeman, R. Nelson, G. Silverberg, & L. Soete (Eds.), Technical change and economic theory (pp. 590–670). London: Pinter.

Atkinson, A. B., & Stiglitz, J. E. (1969). A new view of technological change. Economic Journal, 79(315), 573–578.

Azevedo, J. P. W. (2004). Grqreg: Stata module to graph the coefficients of a quantile regression. Technical report, Boston College Department of Economics.

Barajas, A., Huergo, E., & Moreno, L. (2011). Measuring the economic impact of research joint ventures supported by the EU Framework Programme. Journal of Technology Transfer. doi:10.1007/s10961-011-9222-y.

Binder, M., Hsiao, C., & Pesaran, (2005). Estimation and inference in short panel vector autoregressions with unit roots and cointegration. Econometric Theory, 21, 795–837.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87, 115–143.

Bottazzi, G., Cefis, E., Dosi, G., & Secchi, A. (2007). Invariances and diversities in the patterns of industrial evolution: Some evidence from Italian manufacturing industries. Small Business Economics, 29(1), 137–159.

Cainelli, G., Evangelista, R., & Savona, M. (2006). Innovation and economic performance in services: A firm-level analysis. Cambridge Journal of Economics, 30, 435–458.

Cefis, E., & Ciccarelli, M. (2005). Profit differentials and innovation. Economics of Innovation and New Technology, 14, 43–61.

Cefis, E., & Ghita, M. L. (2008). Post-merger innovative patterns in small and medium firms. Mimeo: Utrecht University.

Cefis, E., & Orsenigo, L. (2001). The persistence of innovative activities: A cross-country and cross-sectors comparative analysis. Research Policy, 30, 1139–1158.

Clausen, T., Pohjola, M., Sapprasert, K., & Verspagen, B. (2012). Innovation strategies as a source of persistent innovation. Industrial and Corporate Change, 21(3), 553–585.

Coad, A. (2010). Exploring the processes of firm growth: Evidence from a vector auto-regression. Industrial and Corporate Change, 19(6), 1677–1703.

Coad, A., & Rao, R. (2008). Innovation and firm growth in high-tech sectors: A quantile regression approach. Research Policy, 37, 633–648.

Coad, A., & Rao, R. (2010). Firm growth and R&D expenditure. Economics of Innovation and New Technology, 19(2), 127–145.

Cohen, W., & Klepper, S. (1996). A reprise of size and R&D. Economic Journal, 106, 925–951.

Crepon, B., Duguet, E., & Mairesse, J. (1998). Research, innovation and productivity: An econometric analysis at the firm level. Economics of Innovation and New Technology, 7(2), 115–158.

David, P. A. (1985). Clio and the economics of QWERTY. American Economic Review, 76, 332–337.

Demirel, P., & Mazzucato, M. (2012). Innovation and firm growth: Is R&D worth it? Industry and Innovation, 19(1), 45–62.

Dosi, G. (1988). Sources, procedures, and microeconomic effects of innovation. Journal of Economic Literature, 26(3), 1120–1171.

Efron, B., & Tibshirani, R. (1993). An introduction to the bootstrap. Boca Raton/Chapman & Hall/CRC.

Freel, M. S. (2000). Do small innovative firms outperform non-innovators? Small Business Economics, 14, 195–210.

Geroski, P. A. (2000). The growth of firms in theory and practice. In N. Foss & V. Mahnke (Eds.), Competence, governance and entrepreneurship. Oxford: Oxford University Press.

Geroski, P. A. (2005). Understanding the implications of empirical work on corporate growth rates. Managerial and Decision Economics, 26, 129–138.

Geroski, P. A., & Machin, S. (1992). Do innovating firms outperform non-innovators? Business Strategy Review, 3(2), 79–90.

Goedhuys, M., & Sleeuwaegen, L. (2010). High growth entrepreneurial firms in Africa: A quantile regression approach. Small Business Economics, 34, 31–51.

Greenhalgh, C., & Rogers, M. (2006). The value of innovation: The interaction of competition, R&D and IP. Research Policy, 35(4), 562–580.

Hall, B. H., Mairesse, J., Branstetter, L., & Crépon, B. (1999). Does cash flow cause investment and R&D? An exploration using panel data for French, Japanese, and United States scientific firms. In D. Audretch & R. Thurik (Eds.), Innovation, industry evolution and employment (pp. 129–156). Cambridge: Cambridge University Press.

Hölzl, W. (2009). Is the R&D behaviour of fast growing SMEs different? Evidence from CIS III data from 16 countries. Small Business Economics, 33(1), 59–75.

Huergo, E., & Jaumandreu, (2004). Firms’ age, process innovation and productivity growth. International Journal of Industrial Organisation, 22, 541–559.

Huergo, E., & Moreno, L. (2011). Does history matter for the relationship between R&D, innovation, and productivity? Industrial and Corporate Change, 20(5), 1335–1368.

Malerba, F., Orsenigo, L., & Peretto, P. (1997). Persistence of innovative activities, sectoral patterns of innovation and international technological specialisation. International Journal of Industrial Organisation, 15, 801–826.

Máñez, J. A., Rochina-Barrachina, M. E., Sanchis, A., & Sanchis, J. A. (2009). The role of sunk costs in the decision to invest in R&D. The Journal of industrial Economics, 57(4), 712–735.

Mansfield, E. (1962). Entry, Gibrat’s law, innovation, and the growth of firms. American Economic Review, 52(5), 1023–1051.

Nickell, S. (1981). Biases in dynamic models with fixed effects. Econometrica, 49(6), 1417–1426.

Peters, B. (2009). Persistence of innovation: stylized facts and panel data evidence. Journal of Technology Transfer, 34, 226–243.

Piva, M., & Vivarelli, M. (2007). Is demand-pulled innovation equally important in different groups of firms? Cambridge Journal of Economics, 31, 691–710.

Raymond, W., Mohnen, P., Palm, F., & van der Loeff, S. S. (2010). Persistence of innovation in Dutch manufacturing: is it spurious? The Review of Economics and Statistics, 92(3), 495–504.

Rochina, M. E., Máñez, J. A., & Sanchis, A. (2010). Process innovation and firm productivity growth: Does size matter? Small Business Economics, 34, 147–166.

Rogers, M. (2004). Networks, firm size and innovations. Small Business Economics, 22, 141–153.

Roper, S., & Hewitt-Dundas, N. (2008). Innovation persistence: Survey and case-study evidence. Research Policy, 37, 149–162.

Ruttan, V. W. (1997). Induced innovation, evolutionary theory and path dependence: Sources of technical change. The Economic Journal, 107, 1520–1529.

Schmookler, J. (1962). Economic sources of inventive activity. The Journal of Economic History, 22(1), 1–20.

Schumpeter, J. (1942). Capitalism, socialism and democracy. New York: Harper.

Stam, E., & Wennberg, K. (2009). The roles of R&D in new firm growth. Small Business Economics, 33(1), 77–89.

Stock, J. H., & Watson, M. W. (2001). Vector autoregressions. Journal of Economic Perspectives, 15(4), 101–115.

Thompson, P. (1999). Rationality, rules of thumb, and R&D. Structural Change and Economic Dynamics, 10, 321–340.

Triguero-Cano, Á., Cuerva Narro, M. C., & Córcoles González, D. (2012). Persistence of innovation and firm’s growth: Evidence from a panel of Spanish manufacturing firms. Paper presented at the “Firm Growth and Innovation” workshop, Tarragona, 28–29 June 2012.

Acknowledgments

This paper was initiated in the “FINNENTRE” project financed by Tekes and VTT. We thank discussants at the “firm growth and innovation” workshop in Tarragona on 29.6.2012, Alex Coad, Ari Hyytinen, Christopher Palmberg, and two anonymous referees for valuable comments and Statistics Finland for data access.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

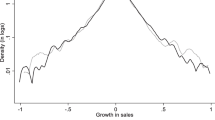

See Tables 6, 7, 8, 9, 10 and 11, Fig. 2.

Quantile regression plot of the responsiveness of R&D expenditure at time t to sales growth at time t–1 based on the estimation of Eq (2) for our complete sample. Note Confidence intervals (non-bootstrapped) extend to 95 % confidence intervals in either direction. Horizontal lines represent OLS estimates with 95 % confidence intervals. Output obtained using stata module qrqreg of Azevedo (2004). Source Statistics Finland

Rights and permissions

About this article

Cite this article

Deschryvere, M. R&D, firm growth and the role of innovation persistence: an analysis of Finnish SMEs and large firms. Small Bus Econ 43, 767–785 (2014). https://doi.org/10.1007/s11187-014-9559-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-014-9559-3