Abstract

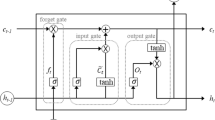

In the field of quantitative finance, how to accurately predict stock prices has become an important issue in the current research. The emergence of LSTM network algorithm solves the complex serialized data learning problem of stock price prediction. However, the current results show that if the LSTM algorithm is used alone, there are still problems such as imbalance and inaccurate local extremes. The explanation of GA (genetic algorithm) is not certainly conclusive in the current financial world, but it has a prominent effect in solving the problem of tuning. In the construction of a new stock price prediction model, the closing price can be predicted by LST neural network algorithm, then the GA genetic algorithm can be used to ensure the accuracy of the model prediction, and the signal of stock price rise and fall can be obtained by the identification mechanism. Based on this, this paper makes a comprehensive analysis of the principles and applications of the existing LSTM model, and highlights the application of LSTM-GA in the field of stock price prediction.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Kumar, K., Haider, M.T.U.: Enhanced prediction of intra-day stock market using metaheuristic optimization on RNN–LSTM network. New Gener. Comput. 57(16), 167–174 (2020)

Sunny, M., Maswood, M., Alharbi, A.G.: Deep learning-based stock price prediction using LSTM and Bi-directional LSTM model. In: 2020 2nd Novel Intelligent and Leading Emerging Sciences Conference (NILES), pp. 87–92 (2020)

Aggarwal, D., Chandrasekaran, S., Annamalai, B.: A complete empirical ensemble mode decomposition and support vector machine-based approach to predict Bitcoin prices. J. Behav. Exp. Financ. 27, 100335 (2020)

Gandhmal, D.P., Kumar, K.: Systematic analysis and review of stock market prediction techniques. Comput. Sci. Rev. 34, 100–190 (2019)

Henriqueb, M., Sobreiro, V.A., et al.: Literature review: machine learning techniques applied to financial market prediction. Expert Syst. Appl. 124, 226–251 (2019)

Chen, J., Liu, D.X., Wu, D.S.: Stock index forecasting method based on feature selection and LSTM model. Comput. Eng. Appl. 55(6), 108–112 (2019)

Baek, Y., Kim, H.Y.: Mod Aug Net: a new forecasting framework for stock market index value with an overfitting prevention LSTM module and a prediction LSTM module. Expert Syst. Appl. 113, 457–480 (2018)

Selvin, S., Vinayakumar, R., Gopalakrishnan, E.A., et al.: Stock price prediction using LSTM, RNN and CNN-sliding window model. In: International Conference on Advances in Computing, Communications and Informatics (ICACCI), pp. 1643–1647. IEEE (2018)

Nelson, D.M.Q., Pereira, A.C.M., Oliveira, R.A.D.: Stock market’s price movement prediction with LSTM neural networks. In: International Joint Conference on Neural Networks. IEEE (2018)

Fischer, T., Krauss, C.: Deep learning with long short-term memory networks for financial market predictions. Fau Discussion Papers in Economics (2017)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Jia, H. (2022). Based on the LSTM-GA Stock Price Ups and Downs Forecast Model. In: Sugumaran, V., Sreedevi, A.G., Xu, Z. (eds) Application of Intelligent Systems in Multi-modal Information Analytics. ICMMIA 2022. Lecture Notes on Data Engineering and Communications Technologies, vol 136. Springer, Cham. https://doi.org/10.1007/978-3-031-05237-8_15

Download citation

DOI: https://doi.org/10.1007/978-3-031-05237-8_15

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-05236-1

Online ISBN: 978-3-031-05237-8

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)