Abstract

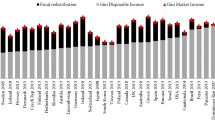

In most OECD-countries income inequality has increased during the last two decades. In this paper, we investigate whether changes in the overall distribution of income can be attributed to social policy measures. For most (but not all) countries we find a possible relationship between changing welfare state policies (as measured by expenditure ratios and replacement rates) and changing income inequality. Especially the United Kingdom and the Netherlands combined an above-average rise in inequality with a reduction in the generosity of the welfare system.

A more elaborate budget incidence analysis for the Netherlands indicates that in the period 1981–1997 inequality of disposable household income increased sharply. The two main forces behind this phenomenon were a more unequal distribution of market incomes and changes in social transfers. Fundamental social security reforms in the Netherlands indeed seem to have made the income distribution less equal. However, income inequality in the Netherlands is still below the OECD average at the end of the observed period.

Similar content being viewed by others

References

Adema, W. (1999). "Net Social Expenditures." Labour Market and Social Policy Occasional Papers No. 39; OECD Working Papers 7(61), OECD, Paris.

Atkinson, A. B. (1970). "On the Measurement of Inequality." Journal of Economic Theory 2, 244–263.

Atkinson, A. B., L. Rainwater and T. M. Smeeding. (1995). "Income Distribution in OECD Countries: Evidence from the Luxembourg Income Study." OECD Social Policy Studies 18, Paris.

Atkinson, A. B. (1996). “Explaining the Distribution of Income.” In J. Hills (ed.), New Inequalities, Cambridge: Cambridge University Press, pp. 19–48.

Atkinson, A. B. and A. Brandolini. (1999). “Promise and Pitfalls in the Use of "Secondary" Data-Sets: Income Inequality in OECD Countries.” Manuscript. Nuffield College, Oxford and Banca d'ltalia, Research Department.

Atkinson, A. B. (2000). "The Changing Distribution of Income: Evidence and Explanation." German Economic Review 1(1), 3–18.

Atkinson, A. B., A. Brandolini, P. van der Laan and T. Smeeding. (2000). "Producing Time Series Data for Income Distribution: Sources, Methods and Techniques." Paper Prepared for the 26th General Conference of The International Association for Research in Income and Wealth. Cracow, Poland: August 27–September 2.

Barro, R. J. (1999). "Inequality and Growth in a Panel of Countries." NBER Working Paper no. 7038, Cambridge.

Bovenberg, A. L. (2000). "Reforming Social Insurance in The Netherlands." International Tax and Public Finance 7(3), 345–371.

Caminada, K. and K. P. Goudswaard. (1996). "Progression and Revenue Effects of Income Tax Reform." International Tax and Public Finance 3(1), 57–66.

Champernowne, D. G. (1974). "A Comparison of Measures of Inequality of Income Distribution." Economic Journal 84, 787–816.

Coulter, P. B. (1989). Measuring Inequality: A Methodological Handbook, London: Westview Press.

Dalton, H. (1936). Pinciples of Public Finance, 3rd ed., London: George Routledge & Sons.

Deininger, K. and L. Squire. (1996). "A New Data Set Measuring Income Inequality." The World Bank Economic Review 10(3), 565–592.

Dollar, D. and A. Kraay. (2000). "Growth Is Good for the Poor." World Bank, Development Research Group, (forthcoming Working Paper).

Duclos, J.-Y. (2000). "Gini Indices and Redistribution of Income." International Tax and Public Finance 7(2), 141–162.

Eriksson, I. and T. Pettersson. (2000). "Income Distribution and Income Mobility-Recent Trends in Sweden." In R. Hauser and I. Becker (ed.), The Personal Distribution of Income in an International Perspective, Berlin, Germany, Springer-Verlag, pp. 158–175.

Ervik, R. (1998). "The Redistributive Aim of Social Policy. A Comparative Analysis of Taxes, Tax Expenditure Transfers and Direct Transfers in Eight Countries." LIS Working Paper Series 184, Luxembourg.

Figini, P. (1998). "Inequality Measures, Equivalence Scales and Adjustment for Household Size and Composition." LIS Working Paper Series 185, Luxembourg.

Formby, J. P., W. J. Smith and P. D. Thistle. (1990). "The Average Tax Burden and the Welfare Implications of Global Tax Progressivity." Public Finance Quarterly 18(1), 3–24.

Föster, M. (2000). "Trend and Driving Factors in Income Distribution and Poverty in the OECDF Area." Labour Market and Social Policy Occasional Papers No. 42, OECD, Paris.

Gelauff, G. M. M. and J. J. Graafland. (1994). "Modelling Welfare State Reform." Amsterdam, Elsevier Science.

Gillespie, W. I. (1965). "Effects of Public Expenditures on the Distribution of Income." In R. Musgrave (ed.), Essays in Fiscal Feralism, Washington: The Brookings Institution.

Gottschalk, P., B. Gustafsson and E. Palmer. (ed.), (1997). Changing Patterns in the Distribution of Economic Welfare, Cambridge: Cambridge University Press.

Gottschalk, P. and T. M. Smeeding. (1997). "Cross-National Comparisons of Eamings and Income Inequality." Journal of Economic Literature 35 (June), 633–687.

Gottschalk, P., and T. M., Smeeding. (1998). "Empirical Evidence on Income Inequality in Industrialized Countries." LIS Working Paper Series 154 (revised), Luxembourg.

Gottschalk, P. and T. Smeeding. (2000). "Empirical Evidence on Income Inequality in Industrialized Countries." In A. B. Atkinsin and F. Bourgignon (eds.), Handbook of Income Distribution, New York: Elsevier-North Holland Publishers, Vol. 1, pp. 262–307.

Gouyette, C., and P. Pestieau. (1999). "Efficiency of the Welfare State." Kyklos 52(4), 537–553.

Gustafsson, B. and M. Johansson. (1997). "In Search for a Smoking Gun: What Makes Income Inequality Vary Over Time in Different Countries?" LIS Working Paper Series 172, Luxembourg.

Headey, B., R. E. Goodin, R. Muffels and H.-J. Dirven. (1997). "Welfare Over Time: Three Worlds of Welfare Capitalism in Panel Perspective." Journal of Public Policy 17(3), 329–359.

Jeurissen, P. C. J. (1995). "Robin Hood in Nederland." (Robin Hood in the Netherlands) Sociaal-economische maandstatistiek 12(4), 17–21.

Kakwani, N. C. (1977a). "Measurement of Tax Progressivity: An International Comparison." Economic Journal 87, 71–80.

Kakwani, N. C. (1977b). "Applications of Lorenz Curves in Economic Analysis." Econometrica 45(3), 719–727.

Kakwani, N. C. (1986). Analyzing Redistribution Policies, Cambridge: Cambridge University Press.

Kiefer, D. W. (1984). "Distributional Tax Progressivity Indexes." National Tax Journal 37, 497–513.

Kleijn, J. P. De (1998). "Inkomensverdeling 1996." (Income Distribution 1996) Sociaal-economische maandstatistiek 15(3), 18–22 and 75–85.

Lambert, P. J. (1993). The Distribution and Redistribution of Income: A Mathematical Analysis, 2nd ed., Manchester: Manchester University Press.

Ministry of Social Affairs (1995). Sociale Nota 1996 (in Dutch), Sdu Uitgevers, The Hague.

Ministry of Social Affairs (1999). Sociale Nota 2000 (in Dutch), The Hague: Sdu Uitgevers.

Musgrave, R. A. and Thin Tun. (1948). "Income Tax Progression, 1929–48" Journal of Political Economy 56, 498–514.

Musgrave, R. A., K. E. Case and H. B. Leonard. (1974). "The Distribution of Fiscal Burdens and Benefits." Public Finance Quarterly 2 (July), 259–311.

Muysken, J., T. van Veen and E. de Regt. (1999). "Does a Shift in the Tax Burden Create Unemployment?" Applied Economics 31, 1195–1205.

Odink, J. G. (1985). Inkomensherverdeling-enkele aspecten van de inkomensherverdeling door de overheid in Nederland (PhD in Dutch about Income Redistribution), Wolters-Noordhoff, Groningen.

OECD (1994) The OECD Jobs Study: Facts Analysis Strategies. Paris: OECD.

OECD (1994) The OECD Jobs Study: Evidence and Explanations (part 1 and 2), Paris, OECD.

Reynolds, M., and E. Smolensky. (1977). "Post Fisc Distributions of Income 1950, 1961, and 1970" Public Finance Quarterly 5, 419–438.

Ringen, S. (1991). "Households, standard of living and inequality." Review of Income and Wealth 37, 1–13.

Schiepers, J. M. P. (1998). "Equivalentiefactoren: methode en belangrijkste uitkomsten." (Equivalence Scales for the Netherlands: Methodology and Main Results), in: CBS Jaarboek Welvaartsverdeling 1998, Kluwer/CBS, Deventer, 117–121.

Silber, J. (1994). "Income Distribution, Tax Structure, and the Measurement of Tax Progressivity" Public Finance Quarterly 22 (1), 86–102.

Smeeding, T. (2000). "Changing Income Inequality in OECD Countries: Updated Results from the Luxembourg Income Study (LIS)." In R. Hauser and I. Becker (eds.), The Personal Distribution of Income in an International Perspective. Berlin, Germany, Springer-Verlag, 205–224.

Smolensky, E., W. Hoyt and S. Danziger. (1987). "A Critical Survey of Efforts to Measure Budget Incidence." In H. M. van de Kar, B. L. Wolfe (eds.), The Relevance of Public Finance for Policy-Making. Proceedings IIFP Congress 1985, Detroit, 165–179.

Sociaal en Cultureel Planbureau (1998) Sociaal en Cultureel Rapport 1998. 25 jaar sociale verandering (Social Cultural Report 1998), SCP, Rijswijk.

Statistics Netherlands, CBS (1999). "Inkomensverdeling 1977–1997. Tabellen' (Income Distribution 1977–1999. Tables) Sociaal-economische maandstatistiek 16(5), 107–119.

Trimp, L. (1993). "Inkomens van huishoudens, 1977–1990" (Income of Households, 1977–1990) Sociaaleconomische maandstatistiek 10(7), 16–18.

Trimp, L. (1999). "Inkomensverdeling 1977–1997." (Income Distribution 1977–1997) Sociaal-economische maandstatistiek 16(5), 21–27.

Whiteford, P. (1995). "The use of replacement rates in international comparisons of benefit systems." International Social Security Review 48(2), 3–30.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Caminada, K., Goudswaard, K. International Trends in Income Inequality and Social Policy. International Tax and Public Finance 8, 395–415 (2001). https://doi.org/10.1023/A:1011262706412

Issue Date:

DOI: https://doi.org/10.1023/A:1011262706412